EXPEDITORS NOTICE OF ANNUAL MEETING & PROXY STATEMENT 202

EXPEDITORS NOTICE OF ANNUAL MEETING & PROXY STATEMENT 202Resolve Our People Expeditors International of Washington Inc. Corporate Headquarters Seattle, WA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

☐ Preliminary Proxy Statement

☐Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-12

Expeditors International of Washington, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (check the appropriate box)(Check all boxes that apply):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Expeditors® 2019 Notice of Annual Meeting & Proxy Statement EXPEDITORS INTERNATIONAL OF WASHINGTON, INC. CORPORATE HEADQUARTERS SEATTLE, WA

EXPEDITORS NOTICE OF ANNUAL MEETING & PROXY STATEMENT 202

EXPEDITORS NOTICE OF ANNUAL MEETING & PROXY STATEMENT 202

Resolve Our People Expeditors International of Washington Inc. Corporate Headquarters Seattle, WA

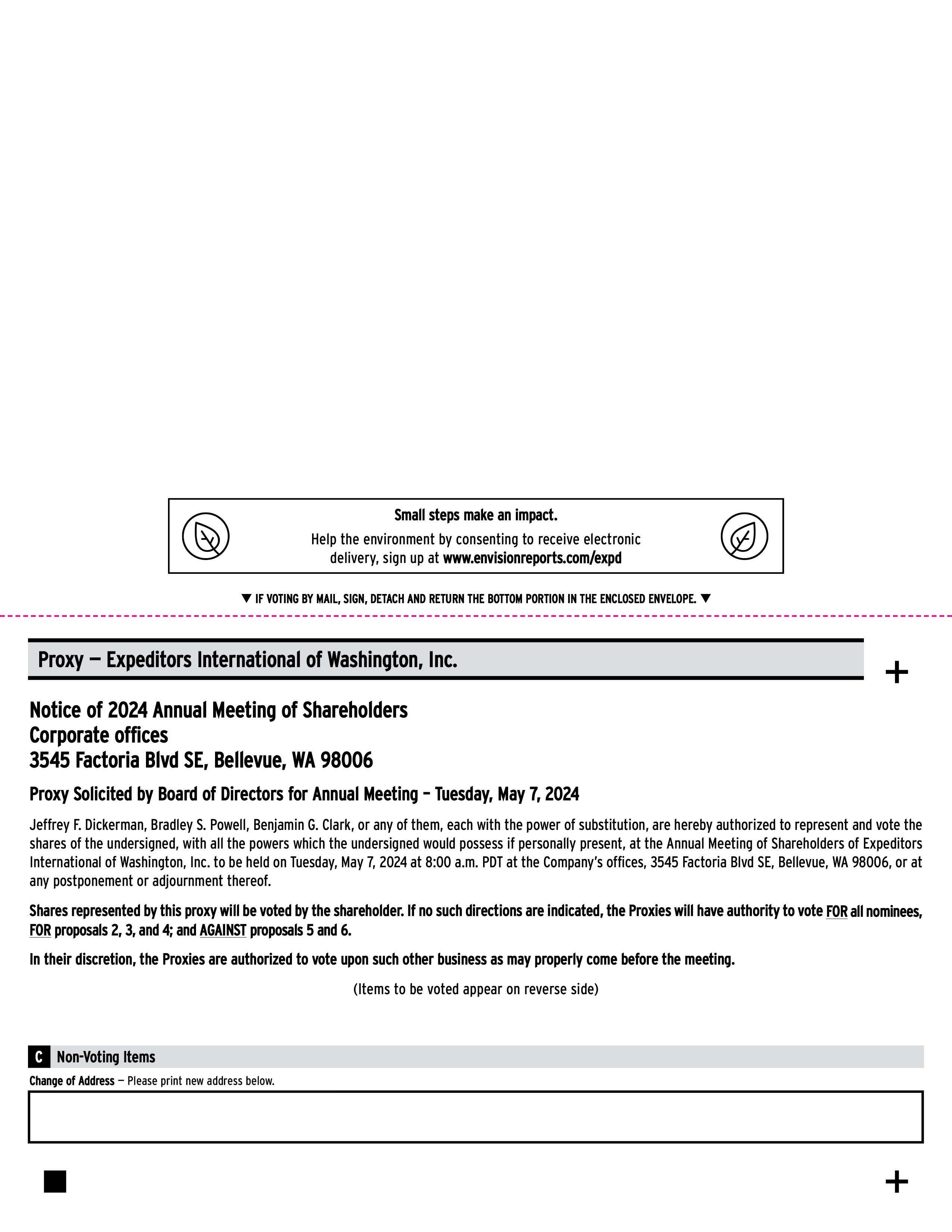

March 26, 2024

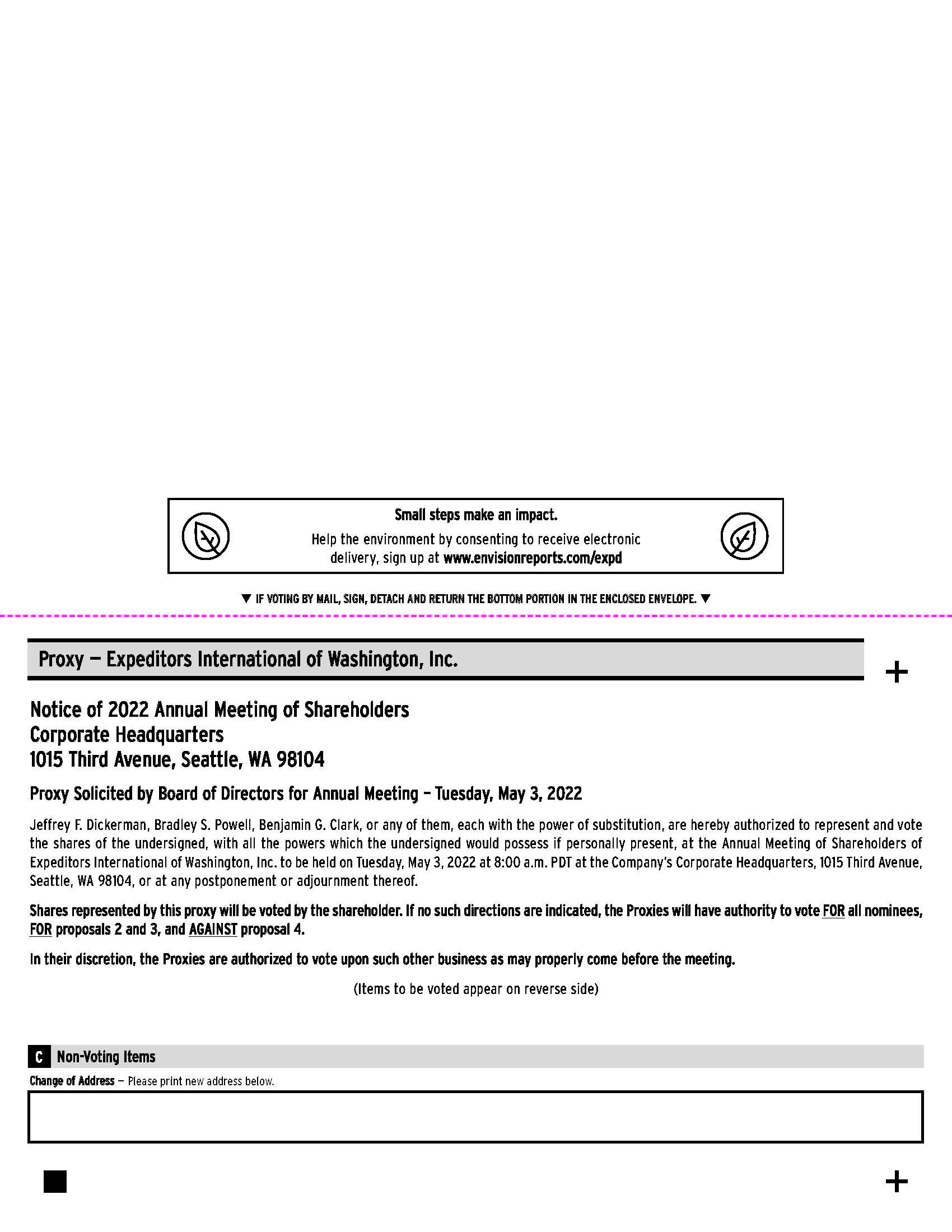

March 22, 2022

To Our StakeholdersShareholders

Twelve months ago we looked back onCompared to the pandemic years, 2023 should have been relatively benign. The skyrocketing demands of a year unlike any other in the 40+ years since Expeditors’ was founded. We wrote with pride of our resiliency, adaptability, and fortitude as the world was hit by a pandemic that shut down and then transformed thestay-at-home economy evaporated; global supply chain as never before. Unlike a great many companies, Expeditors instituted a “no layoff” policy early in 2020, just as we had duringbottlenecks and dislocations largely disappeared; the 2008-09 financial crisis. Our deep industry experience had taught us to hold tight to our most valuable assets, our people, during uncertain times and in preparation for when business rebounds. This commitment to our employees paid off again.

And yet nothing could have quite prepared us for the growth we experienced in 2021, as uneven, ever-shifting pandemic restrictions coincided with heightened constraintsmassive shortage of available space in the air and on the oceans critical laborreversed course; and equipment shortages,rates plummeted from unsustainable all-time highs. In comparison to that combination of events, 2023 should have been a relatively normal year by historical standards.

But when the massive disruptions and pricing and rate volatility unlike anythingchaos of the pandemic years began to unwind, we had ever seen before. Our valuable, hard-working people – the very same people we prudently retained when things looked so bleak at the startentered a period that was no less disruptive than were any of the COVID-19 pandemic – worked even harder and with more dedication and flexibility to find solutions for our customers.

To say that accessing cargo space in 2021 was difficult is an understatement. Never before have our global network and our close carrier relationships been tested as they have been over the past 12 months, when the vast majority of air capacity remained grounded and so many ships lay anchored offshore and unable to unload on a timely schedule. Despite such difficult operating conditions, when a majority of our people were still working off-site and from home, we produced record results in tonnage and volumes, revenues, operating income, and net earnings throughout the year, as we redoubled our efforts to secure precious capacity for our customers.

So far in early 2022, the global supply chain continues to be challenged. As we file our 2022 Proxy Statement, the world and our industry remain highly unpredictable. But our focus remains on our customers, our carrier partners, and our people, as we continue to be confident that those are the priorities that will lead to ongoing success throughout this year and those thereafter.

Subsequentyears. Compared to the year-end, in late February 2022, in oneyears of pandemic chaos, which triggered the most impactful eventsgreatest run of profitability in our company’s history, 2023 might appear disappointing. Yet revenues and operating income were stronger in 2023 than the last pre-pandemic year of 2019. Unlike 2019, we determinedspent much of 2023 quickly adjusting to tumbling demand, surging capacity, and rapid declines in pricing, making last year as disruptive as the prior three years, just in the opposite direction.

As during other times of momentous disruption, we have remained flexible and deliberate in how we adapt, holding close those things that are most important to our culture and our long-term success. As operating conditions began to whiplash in late 2022 and throughout 2023, we chose not to over-correct. We thoughtfully downshifted our costs to bring operating efficiencies back to historical norms. We did not conduct sweeping reductions in headcount that we werebelieve would be detrimental to our future success. Throughout our long history we have learned that down times are optimal for refining our processes and strengthening our organization for the subjectmore robust times to come.

Notwithstanding the potential impact from the latest myriad geopolitical conflicts, there are reasons for optimism. Air volumes ticked up modestly on a sequential basis in the second half of a targeted cyber-attack, prompting2023, and global economic uncertainty and excess inventory did not spark the freight recession that many had feared in 2023, suggesting perhaps that shippers, carriers – all of us – have learned some important lessons about the fragility of supply chains. We are optimistic enough to shut down mostbelieve those lessons will be good for us and for the future of our operating systems globally to manage the safety of our overall global systems environment. We have since been working around the clock to restore our systems and, as we file this Proxy, we are making significant progress in returning to normal operations.industry.

Stepping off the board after nearly 14 years, I strongly believe that the Company’s best days are ahead of us. It has been one of the greatest privileges of my professional career to serve with the incredible Executive Team and Board of Directors of Expeditors. Your next Board Chairman, Bob Carlile, has already served as Chairman of the Audit Committee and brings decades of leadership and financial experience. In addition, we welcome Olivia Polius and Brandon Pedersen as new members of the Board of Directors. Each brings unique skills and diverse perspective to our expanded and refreshed Board.

There is an old proverb of uncertain origin that suggests one is lucky to live in interesting times, suggesting among other things that heightened opportunity is there for those able to adapt. We certainly are living in interesting times and we eagerly embrace the unknown with the best employees in the industry and well-earned conviction that we are up to the challenges that lie ahead.

We ask for your vote:

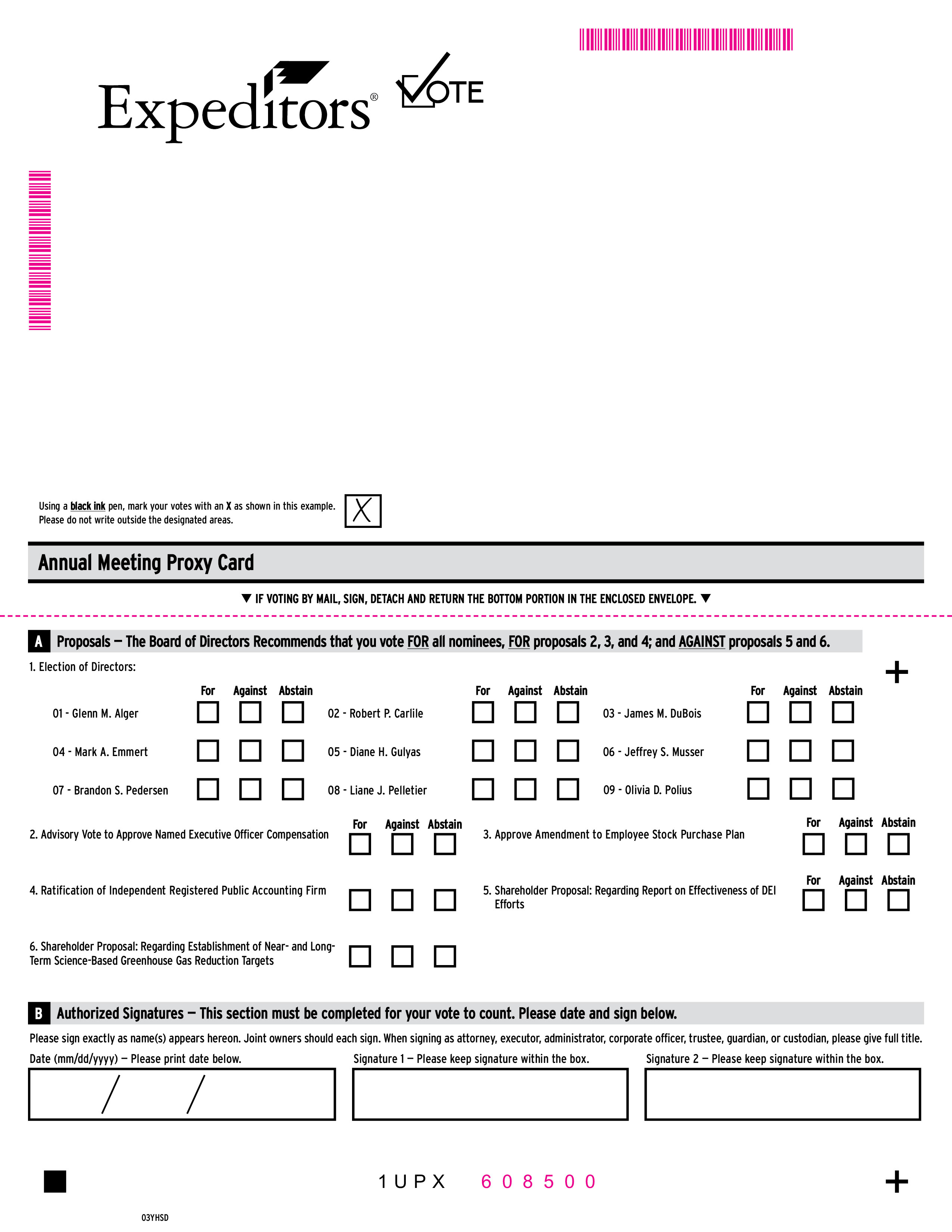

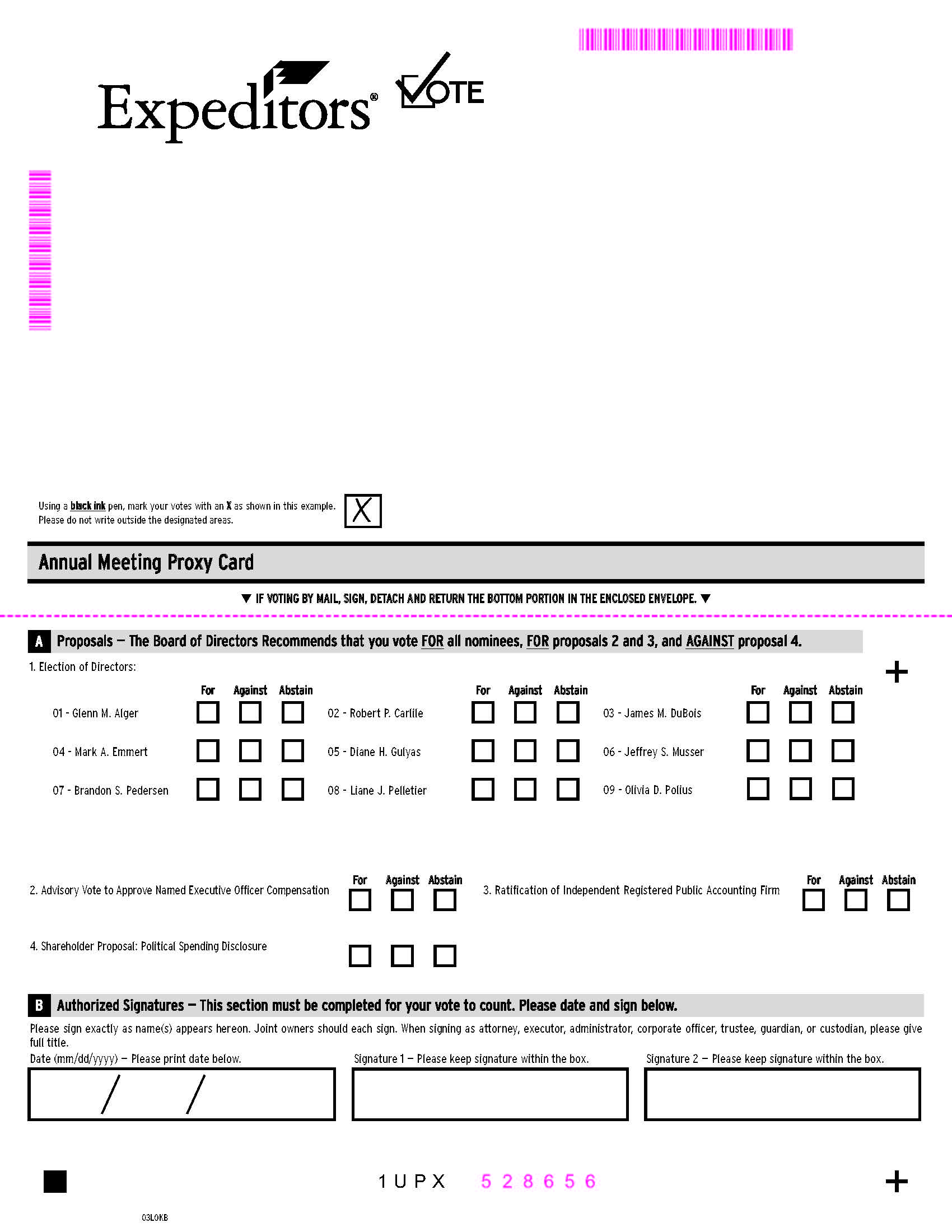

You are askedWe ask you to vote FOR the Board’s nine recommended director nominees and twothree proposals put forth by the Board of Directors,Directors.

We also ask you to carefully evaluate and to vote AGAINST one two shareholder proposalproposals that we believe isare unnecessary, counter-productive, and costly for shareholders. They are out of step with the increased recognition that many of these over-reaching, politically motivated special interest initiatives are harming shareholders and other corporate stakeholders.

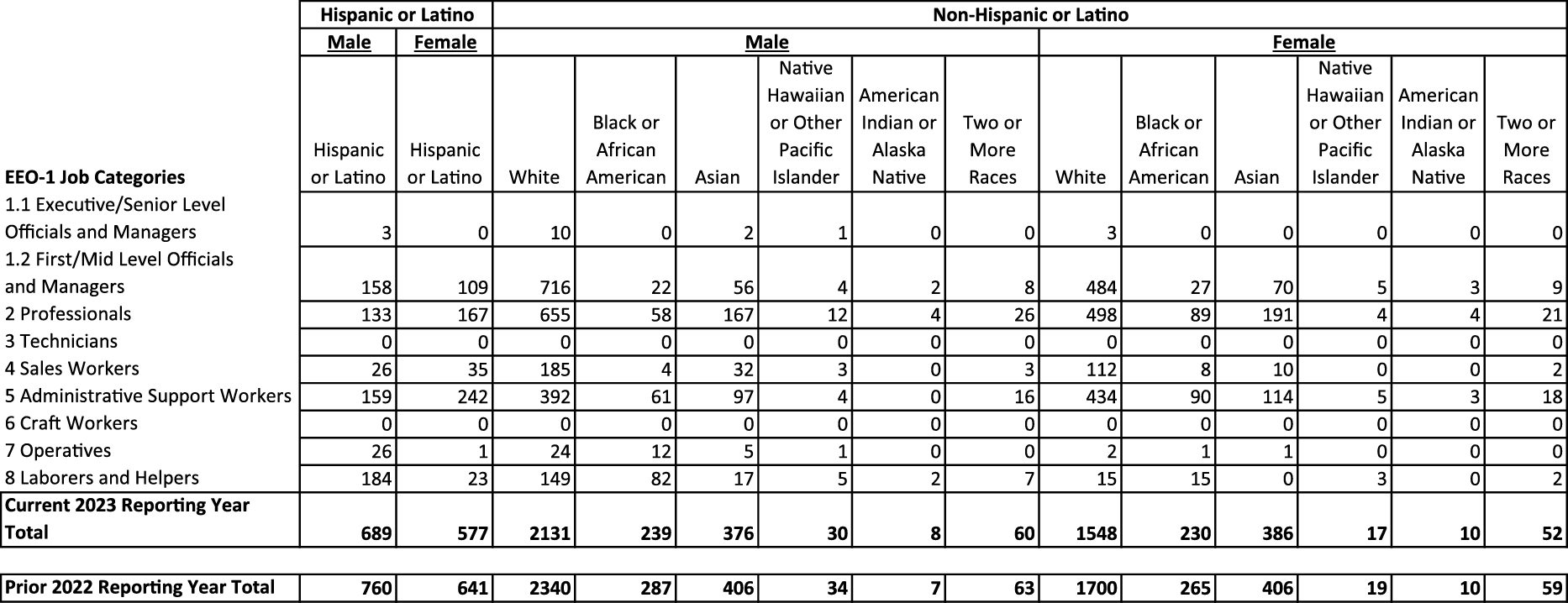

The first proposal is similar to a proposal received last year. Given shareholder feedback last year, we are making meaningful, responsive disclosures to address the proponent’s information requests. That information is provided in this proxy and includes: our full EEO-1 report on U.S. workers; the complete gender mix of our non-U.S. workforce; and a report showcasing the makeup of our Senior Management team over the last ten years, which has changed significantly under the leadership of our CEO. All new Senior Management team leaders have been promoted from within, a testament to our naturally diverse workforce that strives to grow into leadership roles.

We do not believe any further DEI reports are necessary – additional reports would be costly to prepare while failing to provide any further meaningful information on a stand-alone basis; and would not be useful in light of a culture that already invests in people, rewards for performance and naturally attracts, develops, and promotes a diverse employee base, including our Senior Management team, as illustrated in our recent disclosures this year. In addition, there are specific prohibitions against gathering more detailed data in many of the countries in which we operate.

A second shareholder proposal asks that we establish near- and long-term greenhouse gas reduction targets that cover our “full range of operational and supply chain logistics.” We set Scope 1 and Scope 2 targets in 2023 and provide an update on our progress in the discussion of our commitments to ESG within these pages. However, this shareholder proposal assumes we have the means to go further and set mandates for our air or ocean carrier partners, and that we can demand that our customer shippers use greener modes of transport than they may be willing or able to afford. This shareholder proposal also demands that we commit future generations of management to achieving targets many years or decades from now, whether or not those targets are even capable of being achieved.

As always, we thank you for investing with us and we remain dedicated to sustaining your trust. We recognize that you have many choices of where to invest, and we are grateful that you chose to invest with us in Expeditors.

On behalf of the entire Board of Directors, we thank our employees, customers, service providers, communities and you, our shareholders, for your continued support and your investment in our business.

Sincerely,

/s/ Robert R. WrightP. Carlile

Robert R. Wright

ChairmanChair of the Board of Directors

TABLE OF CONTENTS

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Tuesday | • Election of Directors |

| • |

|

|

| • Ratification of Independent Registered Public Accounting Firm |

• Vote on two shareholder proposals, if presented at Meeting | |

Expeditors International | |

3545 Factoria Blvd SE, Suite 300 |

|

| |

| |

| Record Date: Close of business on March |

Attending the Annual Meeting

Attendance at the Meeting is limited to shareholders able to present evidence of ownership as of the Record Date. All shareholders must be prepared to present valid photo identification to be admitted to the Meeting. Cameras (including cellular phones), recording devices and other electronic devices, and the use of cellular phones, will not be permitted at the Meeting. Representatives will be at the entrance to the Meeting, and these representatives will have the authority, on the Company’s behalf, to determine whether the admission policy and procedures have been followed and whether you will be granted admission to the Meeting.

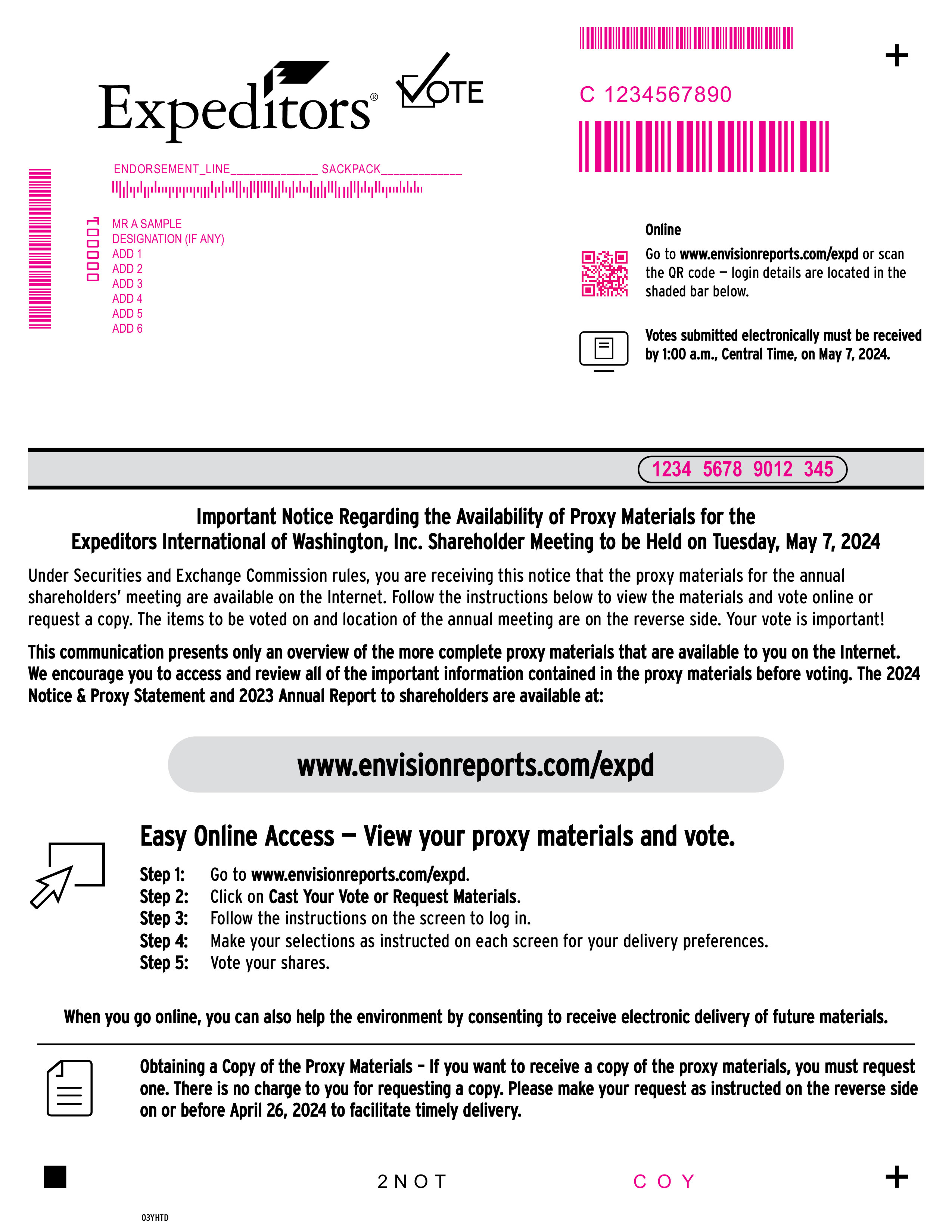

Availability of Proxy Materials

This Notice of Annual Meeting of Shareholders and related proxy materials are being distributed or made available to shareholders beginning on or about March 22, 2022.26, 2024. This includes instructions on how to access these materials (including our Proxy Statement and 20212023 Annual Report to shareholders) online.

Please vote your shares

We encourage shareholders to vote promptly, as this will save the expense of additional proxy solicitation.

You may vote in the following ways:

By Order of the Board of Directors,

Expeditors International of Washington, Inc.

/s/ Jeffrey F. Dickerman

Jeffrey F. Dickerman

Corporate Secretary

Seattle,Bellevue, Washington

March 22, 202226, 2024

Notice of Annual Meeting & Proxy Statement | 1

This Proxy Statement and the accompanying form of proxy are furnished in connection with the solicitation of proxies by the Board of Directors of Expeditors International of Washington, Inc. (the Company, Expeditors, we, us, our) for use at the Annual Meeting of Shareholders (the Annual Meeting). This proxy summary is intended to provide a broad overview of the items that you will find elsewhere in this Proxy Statement. As this is only a summary, we encourage you to read the entire Proxy Statement for more information about these topics prior to voting.

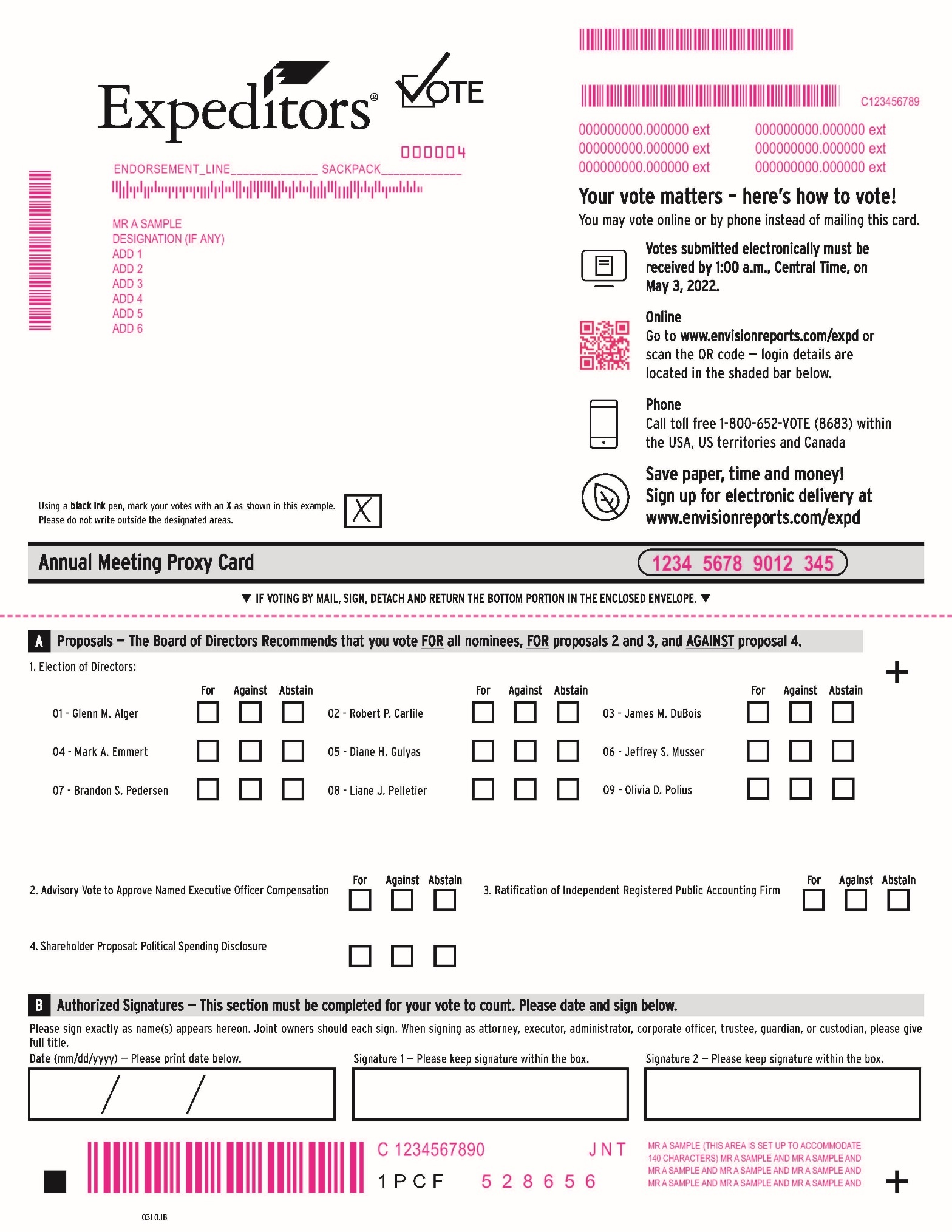

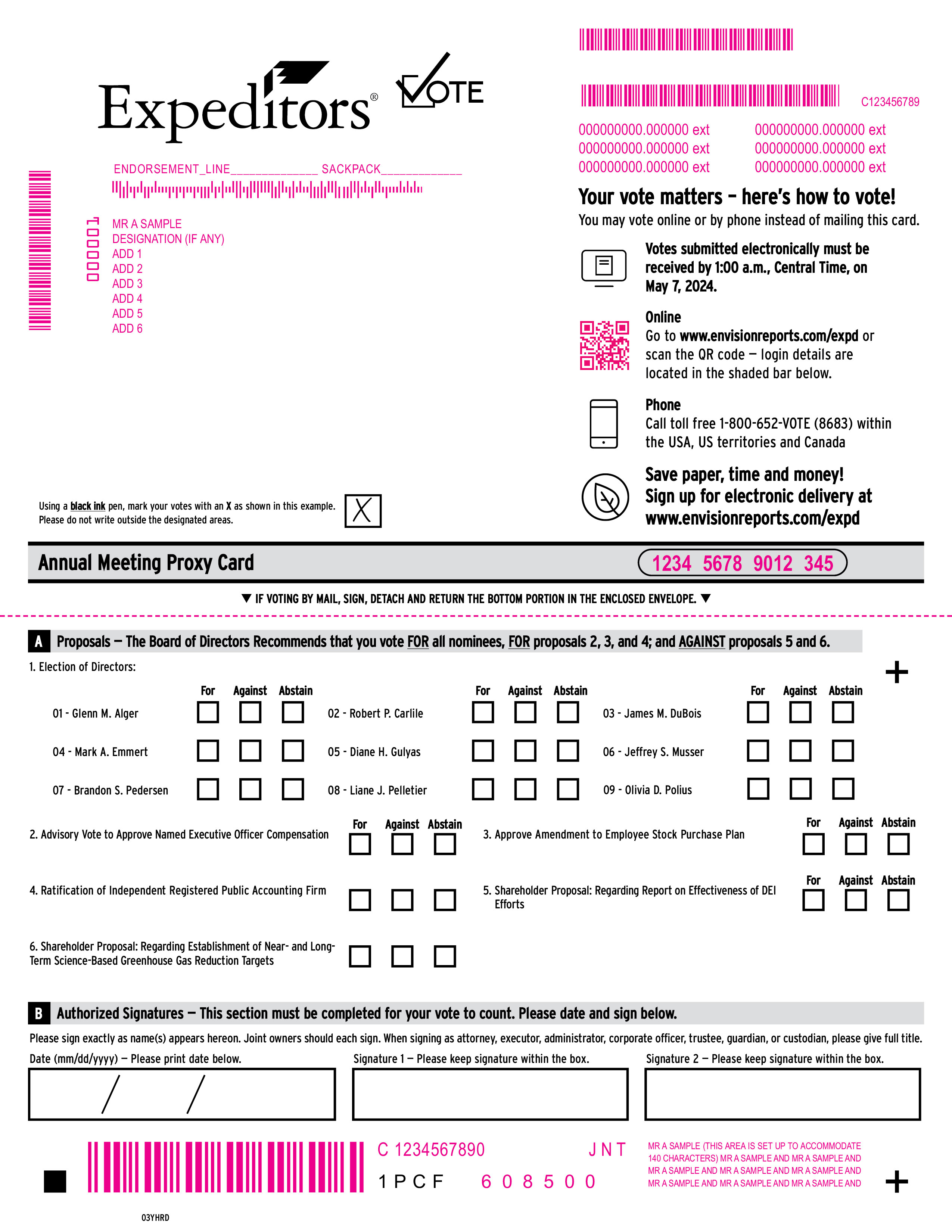

Meeting Agenda & Voting Recommendations

| Board's Voting Recommendation | Page | ||

|

|

| ||

No. 1: Election of Directors | ü | FOR (each nominee) |

| |

No. 2: Advisory Vote to Approve Named Executive Officer Compensation | ü | FOR |

| |

No. 3: Approve Amendment to Employee Stock Purchase Plan | ü | FOR | 35 | |

No. 4: Ratification of Independent Registered Public Accounting Firm | ü | FOR |

| |

No. | X | AGAINST |

| |

No. 6: Shareholder Proposal: Regarding Establishment of Near- and Long-Term Science-Based Greenhouse Gas Reduction Targets | X | AGAINST | 44 | |

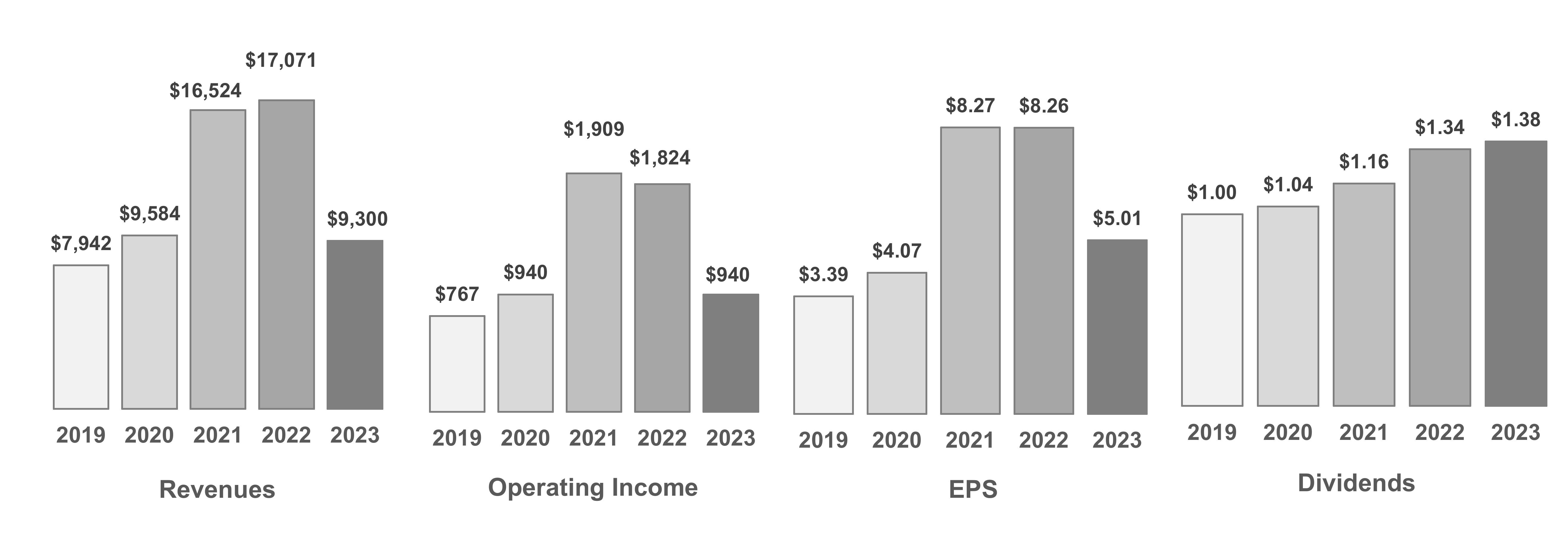

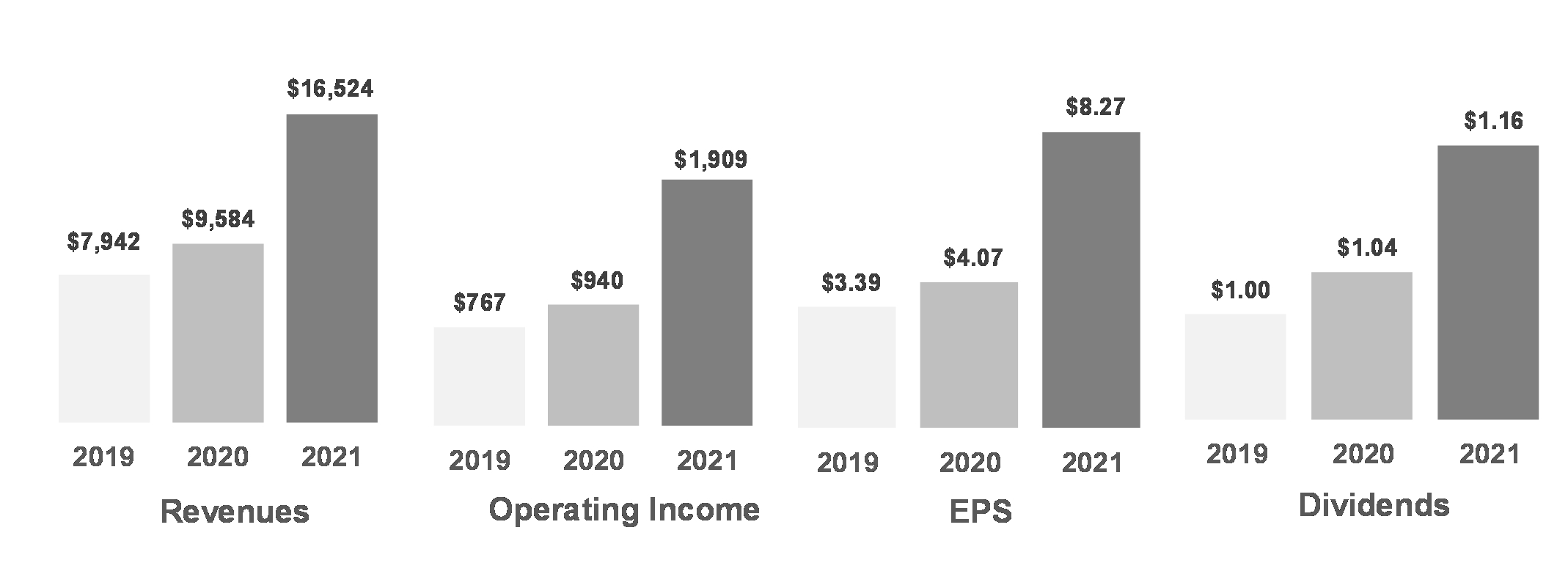

2019-20212019-2023 Financial Performance

(Data in millions except dividends and earnings per share)share (EPS))

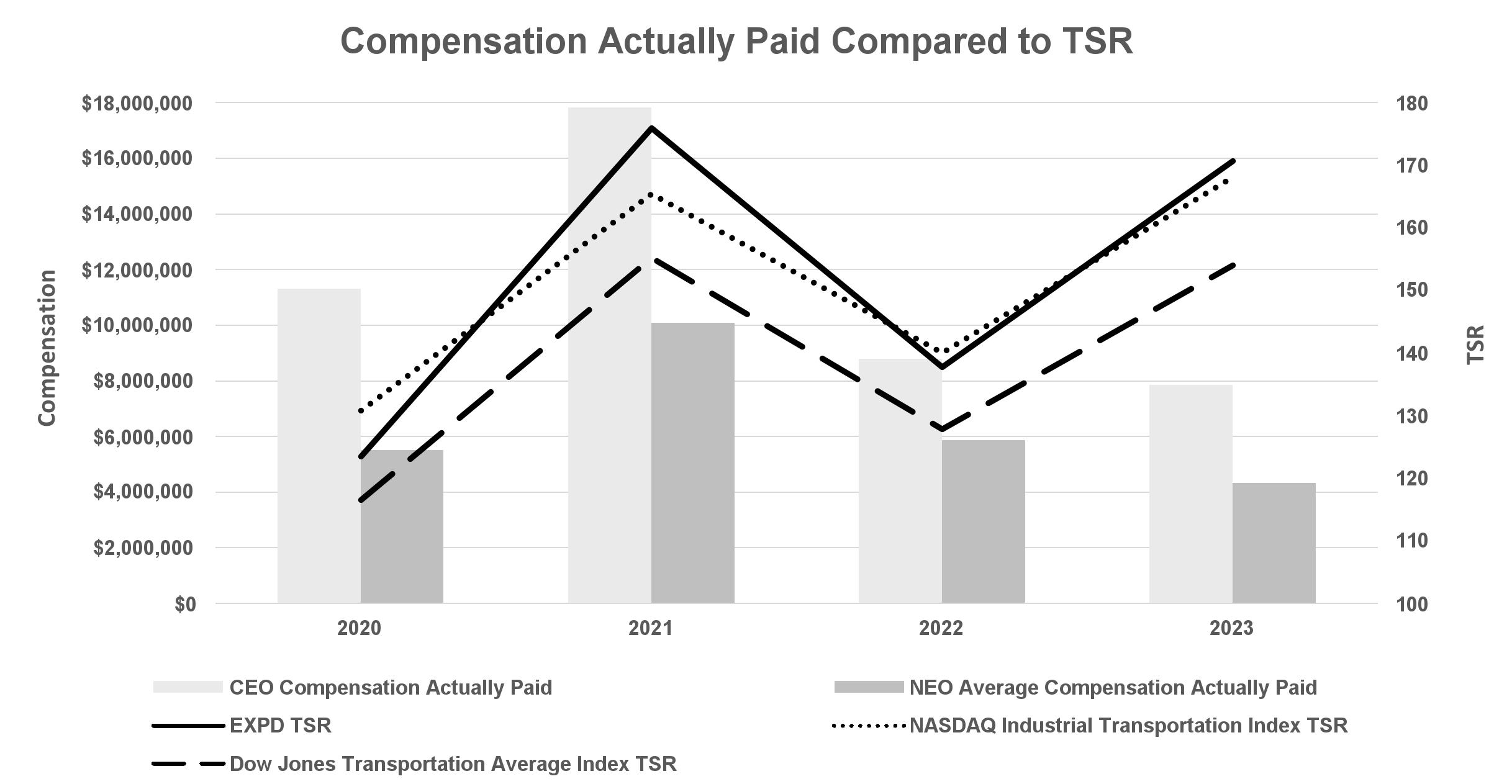

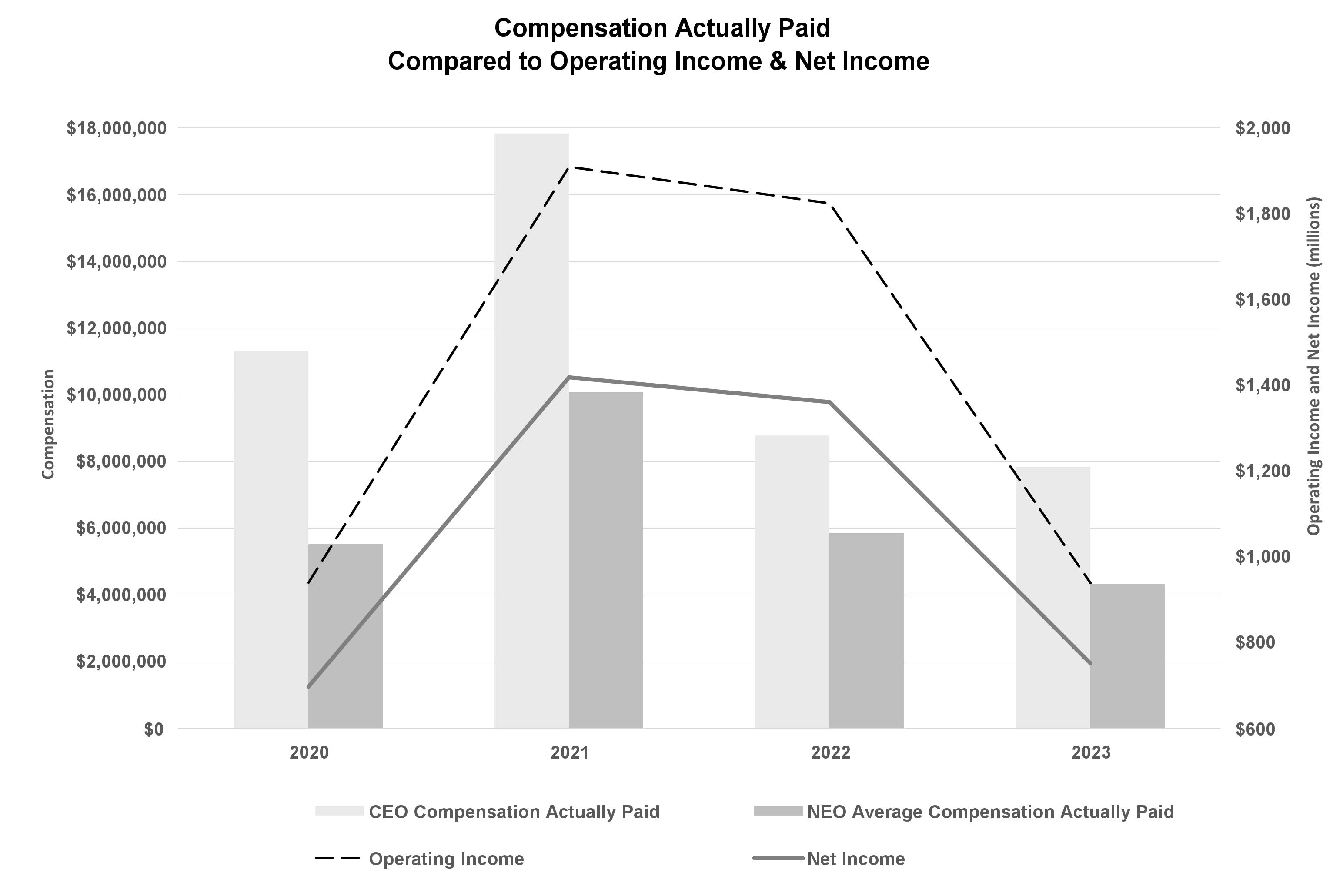

In 2021, the Company again achievedNavigating Post-Pandemic Dislocations: After two years of pandemic shutdowns and supply chain dislocations that led to record revenues, operating income, and EPS,earnings per share, throughout 2023 supply chains operated without significant disruptions and we saw a slowdown in the global economy and a softening of customer demand. As a result, revenues, operating income, and earnings per share declined in 2023.

Return to Shareholders: We generated $1.1 billion in cash flow from operations in 2023 and returned $1.6 billion to shareholders in share repurchases and dividends. We again increased our dividend, maintaining our rare status as a “Dividend Aristocrat,” which refers to companies in the S&P 500 index that have paid and increased their base dividend every year for at least 25 consecutive years.

Notice of Annual Meeting & Proxy Statement | 2

2023 Highlights

ENHANCING OUR COMMITMENT TO SUSTAINABILITY

Expeditors has always been committed to the fundamental values of good environmental, social, and governance (ESG) corporate citizenship since our Company’s inception. Indeed, this commitment is part of our business model and is reflected inperformance and compensation matters throughout the various long-standing mechanisms that we have put in place to promote the best interests of all Expeditors’ stakeholders – including ouryear.

Because we believe that ESG is intricately linked tosenior leadership team.

2 | Expeditors International of Washington, Inc.

the findings of the competed Materiality Assessment. In addition to conducting a Materiality Assessment, in 2022 we also plan to set our own Scope 1 & 2 GHG emissions targets. As we gain momentum with these steps forward, we will continue to focus on making a difference not only by managing our own emissions, but also by collaborating with our customers and service providers – something we are well-positioned to do because we operate as an intermediary at the supply chain orchestration level (i.e., we are non-asset based).

We are also committed to creating a positive and inclusive work environment, free from discrimination and harassment of any kind, for all our employees – our most important asset. Fostering workplace diversity and upward mobility are part and parcel of this important commitment. Case in point, eight12 out of the last 1116 promotions into Expeditors’Expeditors' senior executive team (consisting of the top Senior Vice President roles or above) have been women and/or a person of a diverse background (race, ethnicity, or sexual orientation)LGBTQ+). All

Sustainability

: Additional information about our programs to sustain a healthy environment and reduce greenhouse gas emissions, as well as our approach to social responsibility and sound governance,

Compensation Highlights

We value our shareholders’ views on Named Executive Officer (NEO) compensation and our incentive compensation programs. We continue to extend outreach and regularly engage with those representing half of the outstanding shares to understand their perspectives on our Company performance, including our compensation programs. Shareholders supported our 2021, 2020 and 2019 advisory vote on NEO compensation by 92%, 95% and 94%, respectively, by voting FOR our proposals.

Total compensation to our CEO and to our other NEO increased 76% and 85%, respectively, over 2020 primarily due to participation in our 2008 Executive Incentive Compensation Plan. In 2021, our shareholder-approved 2008 Executive Incentive Compensation Plan performed as design, delivering performance-based compensation that directly correlated to the Company’s 103% increase in operating income. Allocations of the Incentive Pool to NEO did not increase in 2021 over 2020. The Incentive Pool allocation to our CEO was the same in 2021 as 2020. The allocations to other NEO were reduced in the third quarter of 2020 as an offset to PSU awards. Beginning in the second quarter of 2022, the allocation percentage to all senior executive managers (including all NEO) will be reduced by 5% to fund growth initiatives. RSU and PSU awarded to NEO increased 20% in 2021 over 2020 based on Company performance.

Highlights of our compensation program include:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notice of Annual Meeting & Proxy Statement | 3

DIRECTOR IDENTIFICATION & NOMINATION PROCESS

The Policy on Director Nominations, which can be found on the Company’s website at https://investor.expeditors.com, describes the process by which Director nominees are selected by the Nominating and Corporate Governance Committee, and includes the criteria the Committee will consider in determining the qualifications of any candidate for Director. In reviewing candidates for the Board, the Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing Directors for re-election, the individual’s contributions to the Board are also considered.

The Committee annually reviews its nomination procedures to assess the effectiveness of the Policy on Director Nominations. The Committee considers candidates for Director who are recommended by its members, by management, and by search firms retained by the Committee. Per the Policy on Director Nominations, the Committee will also consider any candidate proposed by a shareholder satisfying certain notice provisions, and will take into account the size and duration of the recommending shareholder's ownership. In addition, the Committee ensures that, with respect to any new candidates recruited from outside the Company, the initial list of new candidates includes qualified female and racially/ethnically diverse individuals. Furthermore, the Committee will instruct any retained search firms to include the same on their initial lists of potential candidates submitted to the Committee.

All candidates for Director who, after evaluation, are then recommended by the Committee and approved by the Board of Directors will be included in the Company’s recommended slate of Director nominees in its Proxy Statement.

In addition, any shareholder or group of up to 20 shareholders that has continuously beneficially owned at least 3% of the Company’s Common Stock for at least three years, and who satisfies certain notice, information and consent provisions, may nominate up to 20% of the Directors standing for election and include such nominees on the Company's proxy statement pursuant to the Company's proxy access rights. Lastly, a shareholder may nominate a Director candidate for election outside of the Company's proxy statement if the shareholder complies with the notice, information and consent provisions of Article II of the Company’s Bylaws, which can be found on our website at https://investor.expeditors.com.

Our Bylaws and our Policy on Director Nominations require any notice for Director nominees for shareholder consideration or recommendation of candidates to the Committee be submitted by certain deadlines, which are explained in detail under the heading “Deadlines for Shareholder Proposals for the 2023 Annual Meeting of Shareholders.”

4 | Expeditors International of Washington, Inc.

ELECTION OF DIRECTORS

The Company’s Bylaws require a Board of Directors composed of not less than 6six nor more than 11 members. The Board is currently comprised of tennine members. Expeditors’ Directors are elected at each Annual Meeting to hold office until the next Annual Meeting or until the election or qualification of his or her successor. Any vacancy resulting from the non-election of a Director may be filled by the Board of Directors. The nine nominees are named below. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proposal. As previously announced, current Chairman of the Board of Directors, Robert R. Wright, provided notice to the Board that upon completion of his current term as Director, he would not stand for re-election at the Company’s 2022 Annual Meeting of Shareholders. In connection with Mr. Wright’s decision to not stand for re-election, the Board has appointed Robert P. Carlile as Chair-Elect of the Board.

Nominees for Election

This year’s nominees consist of seven independent Directors and two non-independent Directors. Unless otherwise instructed, it is the intention of the persons named in the accompanying form of proxy to vote shares represented by properly executed proxies for the nine nominees of the Board of Directors named below. Although the Board anticipates that all of the nominees will be available to serve as Directors of the Company, should any one or more of them be unwilling or unable to serve, it is intended that the proxies will be voted for the election of a substitute nominee or nominees designated by the Board of Directors or the seat will remain open until the Board of Directors identifies a nominee.

The Board of Directors has determined that all current Directors except Messrs. Musser and Alger are independent under the applicable independence standards set forth in the rules promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act) and NYSE rules. The Board has designated that only independent Directors can serve as Committee members.

The following persons are nominated to serve as Directors until the Company’s 20232025 Annual Meeting of Shareholders:

ROBERT P. CARLILE

Independent Nominee | Age | Director | 2023 Committee Membership | Other Public | ||

|

|

| NGC | Comp | Audit |

|

Robert P. Carlile | 68 | 2019 | MicroVision, Inc. | |||

James M. DuBois | 60 | 2016 | X | |||

Mark A. Emmert | 71 | 2008 | X | C | Weyerhaeuser Co. | |

Diane H. Gulyas | 67 | 2015 | X | X | Ingevity Corp. | |

Brandon S. Pedersen | 57 | 2022 | X | C | ||

Liane J. Pelletier | 66 | 2013 | C | Frontdoor, Inc. | ||

Olivia D. Polius | 54 | 2021 | X | |||

Non-Independent Nominee |

|

|

|

| ||

|

|

| ||||

Glenn M. Alger | 67 | 2017 | ||||

Jeffrey S. Musser | 58 | 2014 | ||||

Robert “Bob” Carlile became a director in May 2019 and has been appointed by the Board to serve as Chairman of the Board of Directors upon election at the Company’s 2022 Annual Meeting of Shareholders. Mr. Carlile currently serves as the Audit Committee Chair. Prior to that, he was a Partner at KPMG LLP from 2002 to 2016, and Partner at Arthur Andersen LLP from 1987 to 2002. During his 39-year career in public accounting, Mr. Carlile served as the lead audit partner on numerous public company engagements operating across different industries including technology, retail, transportation, bio-science, and manufacturing. In addition to his experience as a lead audit partner, Mr. Carlile held a variety of operating leadership positions at KPMG and Arthur Andersen in the Pacific Northwest. Since 2017, Mr. Carlile has served on the Board of Directors of publicly traded MicroVision Inc, where he is the Audit Committee Chair. Mr. Carlile also serves on the Board of Directors of Virginia Mason Franciscan Health and was past Chairman of the Northwest Chapter Board of the National Association of Corporate Directors (NACD). He is credentialed as a NACD Board Leadership Fellow.

Specific Qualifications, Attributes, Skills & Experience

More than 30 years of senior leadership and management experience.

Extensive audit and accounting experience.

Served as Lead Audit Partner on many global publicly traded companies.

Experienced in corporate board governance and engages in continuous education on leading governance practices.

GLENN M. ALGER

Glenn M. Alger became a Director in May 2017. He is one of the founders of Expeditors and served in various management and senior executive positions over a 25-year period, culminating as President and Chief Operating Officer from September 1999 to May 2007. Prior roles included leading business and operational development in the Americas region and management and evolution of the Company's global products and services. Since his retirement from the Company in 2007, Mr. Alger has been principally engaged as an active investor and manager of his family trust and charitable activities. As a founder, former senior executive of the Company and a long-term shareholder, Mr. Alger brings a deep understanding of both Company operations specifically and the global logistics industry generally.

Specific Qualifications, Attributes, Skills & Experience

More than 30 years of entrepreneurial, business development, management and senior leadership in global logistics.

Direct experience building a business from a startup to a global industry leader.

Industry expertise in customer markets, strategy, competition, organization, technology and finance.

Over 20 years of governance and oversight experience as a senior executive of a public company.

Notice of Annual Meeting & Proxy Statement | 54

JAMES M. DuBOIS

James “Jim” DuBoisDIRECTOR BIOGRAPHIES

ROBERT P. CARLILE

Robert “Bob” P. Carlile became a Director of the Company in May 2016.2019. He was Corporate Vice Presidentappointed Chair of the Audit Committee in May 2020 and Chief Information Officer (CIO) at Microsoft Corporation from 2014 to 2017. As CIO, he was responsible forChair of the company’s global security, infrastructure, collaboration systems,Board in May 2022. Bob’s extensive career in professional services and business applications. Mr. DuBois was appointed CIOnumerous leadership positions benefit the board and management in January 2014 after serving as interim CIO since May 2013. Mr. DuBois served in various other roles at Microsoft, mostly in IT, after joining the company in 1993. These roles include leading IT and product teams for application development, infrastructure and service management. He also served as Microsoft’s Chief Information Security Officer and spent several years working from Asia and then Europe, learning the Microsoft field business while running the respective regional IT teams. He has degrees in computer science and business (accounting). Since leaving Microsoft in September 2017, Mr. DuBois has authored a bookareas including:

Specific Qualifications, Attributes, Skills & Experience

Extensive informationthe evolving global business environment developed over four decades in industries such as global logistics, retail, transportation, technology, experience.

Experience overseeing investments in technology to support business objectives.

Expertise in cybersecurity.

Experience leading global IT teams.

Operating career experiences include:

MARK A. EMMERT

Mark A. Emmert became a Director in May 2008. Since 2010, he has been President of the National Collegiate Athletic Association. From 2004 to 2010, Dr. Emmert served as the President of the University of Washington (UW), a $5 billion per year organization with more than 30,000 employees,

Education background:

Specific Qualifications, Attributes, Skills & ExperienceOther boards:

30 years of experience in executive leadership and administration of educational, healthcare and athletics enterprises.

Expertise in public policy, governmental affairs, and personnel development programs.

Expertise in the leadership and management of complex operations with rigid public oversight requirements.

Expertise in international affairs.

Extensive experience with governance of public and private organizations.

DIANE H. GULYAS

Diane H. Gulyas became a Director in November 2015. Ms. Gulyas worked for DuPont from 1978 until her retirement as President of their $4 billion global Performance Polymers business in September of 2014. During her 36-year career at DuPont, Ms. Gulyas served also as Chief Marketing and Sales Officer, President of Electronic and Communication Technologies Platform, and President of the Advanced Fibers divisions. Ms. Gulyas’ qualifications to serve on the Company’s Board of Directors include over 35 years of senior leadership and global business expertise. Since 2006, Ms. Gulyas has served as a public company director and is currently on the Board of Directors of Ingevity Corporation. She also served on the Board of Directors of W.R. Grace & Company, until it was acquired by Standard Industries Holdings in September 2021.

Specific Qualifications, Attributes, Skills & Experience

More than 35 years of senior leadership and global business expertise.

Substantial and varied management experience and strong skills in engineering, manufacturing (domestic and international), marketing and sales and distribution.

Governance and oversight experience from service as a senior executive of a public company and prior service on a public company board.

6 | Expeditors International of Washington, Inc.

JEFFREY S. MUSSER

Jeffrey S. Musser became a Director of the Company in March 2014. He first joined the Company in February 1983 and was promoted to District Manager in October 1989. Mr. Musser became Regional Vice President in September 1999, Senior Vice President-Chief Information Officer in January 2005 and Executive Vice President and Chief Information Officer in May 2009. Mr. Musser was appointed President and Chief Executive Officer in March 2014.

Specific Qualifications, Attributes, Skills & ExperienceOperating career experiences include:

Over 35 years of experience in the international transportation industry.

Many years of corporate leadership responsibilities.

Background in the information technology discipline.

GLENN M. ALGER

Glenn M. Alger became a Director of the Company in May 2017. His active participation and experience in global logistics as a founder, former senior executive, and a long-term shareholder of the Company deliver benefit to the Board and management, including:

Operating career experiences include:

Notice of Annual Meeting & Proxy Statement | 5

JAMES M. DuBOIS

James “Jim” DuBois became a Director of the Company in May 2016. He serves on the Audit Committee and is the Board expert on cybersecurity and information technology. Jim brings deep experience in several areas that benefit the board and management, including:

Operating career experiences include:

Education background:

Other boards:

MARK A. EMMERT

Mark A. Emmert became a Director of the Company in May of 2008. He chairs the Compensation Committee and serves on the Nominating and Corporate Governance Committee. His wide-ranging leadership experience in the public, private, and nonprofit sectors enable him to support the Board and management in significant ways, including:

Operating career experiences include:

Education background:

Other boards:

Notice of Annual Meeting & Proxy Statement | 6

DIANE H. GULYAS

Diane Gulyas became a Director of the Company in November 2015. She is a member of the Compensation Committee and Nominating and Corporate Governance Committee. Her many years of experience in executive business leadership and board service enable her to contribute to the management team and Board in significant ways, including:

Operating career experiences include:

Education background:

Other Boards:

BRANDON S. PEDERSEN

Brandon S. Pedersen became a Director of the Company in February 2022. Mr. Pedersen servedHe currently chairs the Audit Committee and is a member of the Compensation Committee. Brandon brings deep experience in several areas that benefit the Board and management, including:

Operating career experiences include:

Education background:

Other boards:

Notice of Regents that serves as the University’s audit committee), where he co-facilitates a class on leadership and corporate governance in the Executive MBA program at the UW Foster School of Business. Mr. Pedersen is a Certified Public Accountant.

Specific Qualifications, Attributes, SkillsAnnual Meeting & ExperienceProxy Statement | 7

More than 15 years of commercial airline industry experience.

Experienced chief financial officer with experience in strategic planning, mergers and acquisitions, and organization management.

Extensive accounting and audit experience with publicly-traded companies.

LIANE J. PELLETIER

Liane J. Pelletier became a Director of the Company in May 2013. Ms. Pelletier is the former Chairperson, Chief Executive Officer and President of Alaska Communications Systems, a telecommunication and information technology services provider, leading the firm from October 2003 to April 2011. From November 1986 to October 2003, Ms. Pelletier held a number of executive positions at Sprint Corporation, a telecommunications company. Ms. Pelletier is lead independent director and member of the Compensation Committee on the Board of Directors of ATN International, serves on the board of Frontdoor as member of the Audit and Compensation Committees, and serves on the board of Switch as member ofShe chairs the Nominating and Corporate Governance Committee.

Specific Qualifications, Attributes, Skills & Experience She brings deep experience in several areas that benefit the Board and management, including:

Deep public company board experience over 20 years at seven companies.

Operating career experiences include:

PastSenior Vice President Corporate Strategy and current positions as chair, lead independent Director, and member of audit, risk, nominating and compensation committees of various company boards.Development (last role), Sprint Corporation, 1986-2003 (entire tenure).

Education background:

ExperiencedBachelor’s in corporate board governance and engages in continuous education on information technology and security as well as leading governance practices.

Corporate career and board service spans firms where there is material focus on regulation, information technology and security, foreign operations and customer service.

Credentialed as a NACD Board Leadership Fellow and has earned the certificate in Cybersecurity Oversight from Carnegie Mellon's Software Engineering Institute.

Other boards:

Notice of Annual Meeting & Proxy Statement | 7

OLIVIA D. POLIUS

Olivia D. Polius became a Director of the Company in November 2021. Since 2020, Ms. Polius has servedShe brings a wide-ranging experience from both the private sector and nonprofit sectors that benefit the Board and management, including:

Operating career experiences include:

Education background:

Notice of Annual Meeting & Proxy Statement | 8

How We Identify and acquiredEvaluate Director Candidates

The Policy on Director Nominations describes the process by Micro Focus)which Director nominees are selected by the Nominating and Corporate Governance Committee and includes the criteria the Committee will consider in various roles ranging from Corporate Controllerdetermining the qualifications of any candidate for Director. In reviewing candidates for the Board, the Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to VPthe nomination of Finance.continuing Directors for re-election, the individual’s contributions to the Board are also considered.

Specific Qualifications, Attributes, Skills & ExperienceIn its process of reviewing, nominating, and selecting Director candidates:

More than 20 years of finance, operations management, and strategy experience with global technology and large-scale nonprofit organizations.

Experienced chief financial officer with experience in mergers and acquisitions, finance and accounting, and global operations management.

Experience with compliance relatedCommittee annually reviews its nomination procedures to deploying government funds globally, including sub-Saharan Africa and Asia.

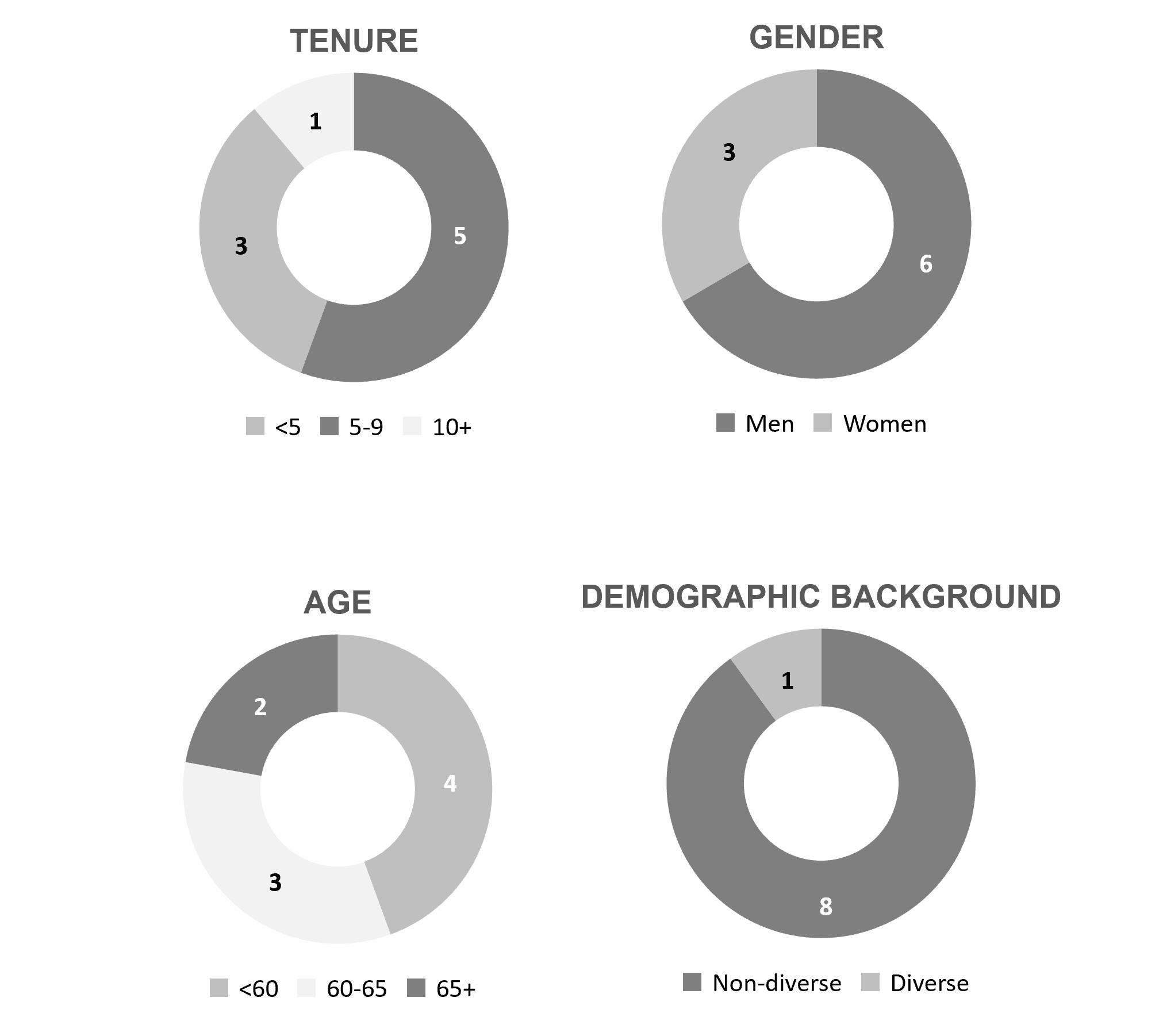

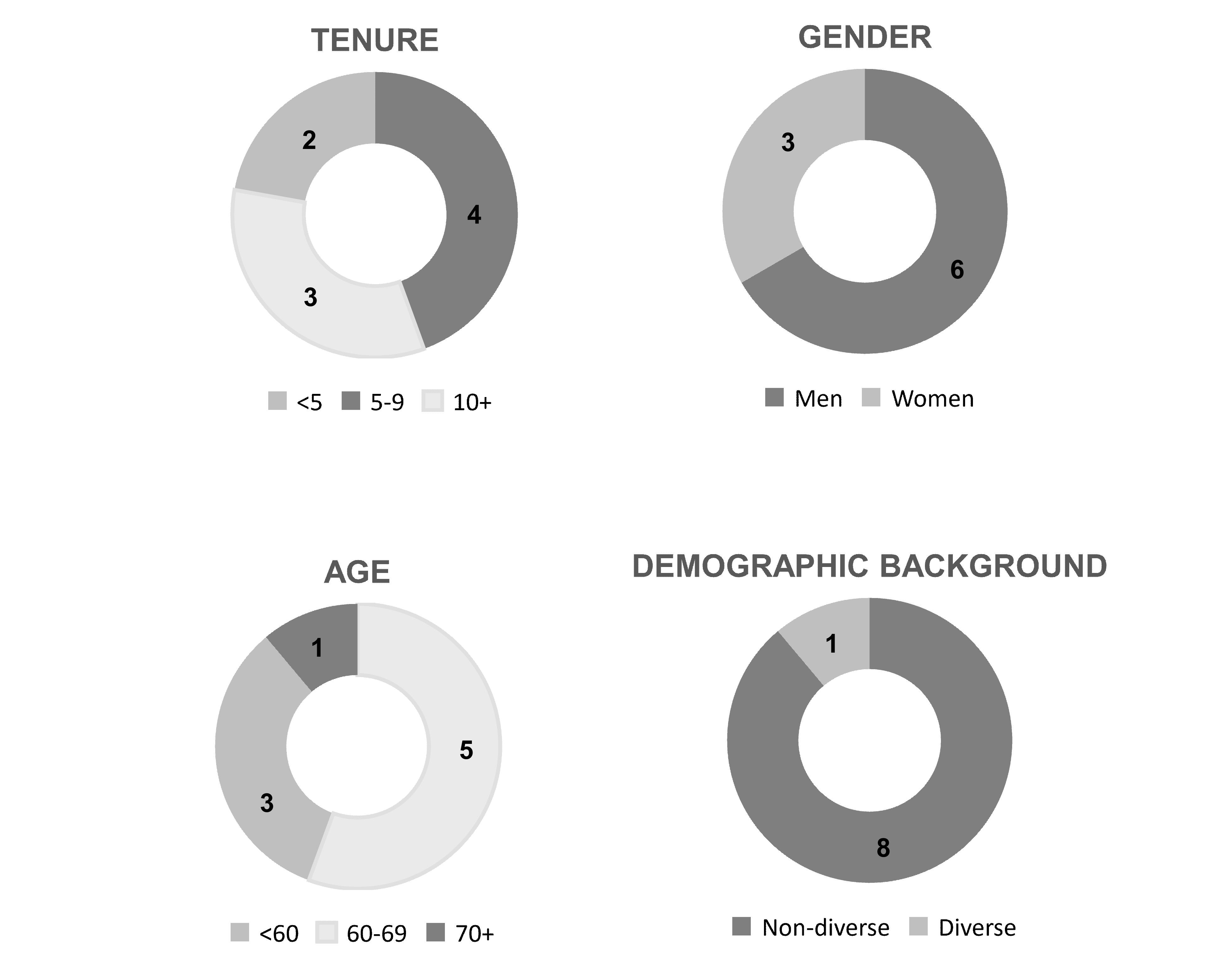

Board Refreshment and Diversity

On our own and in consultation with third parties, our Board has a schedule for evaluating our performance against certain goals, as well as its composition, intending to strike a balance between longer-term service and the fresher perspective that can come from adding new members. We also value industry experience and relevant skills, as our business continues to evolve and our global industry grows more complex.

Because diversity is part of our global culture, we believe that a board should be comprised of directors with diverse backgrounds, experiences, and perspectives that will improve board decision-making and effectiveness. The Board assessesassess the effectiveness of the Policy on Director Nominations.

Our Bylaws and our Policy on Director Nominations require any notice for Director nominees for shareholder consideration or recommendation of candidates to diversity as partthe Committee be submitted by certain deadlines, which are explained in detail under the heading “Deadlines for Shareholder Proposals for the 2025 Annual Meeting of our overall board and committee evaluation process.Shareholders.”

The Policy on Director Nominations can be found on the Company’s website at https://investor.expeditors.com.

8Notice of Annual Meeting & Proxy Statement | Expeditors International of Washington, Inc.9

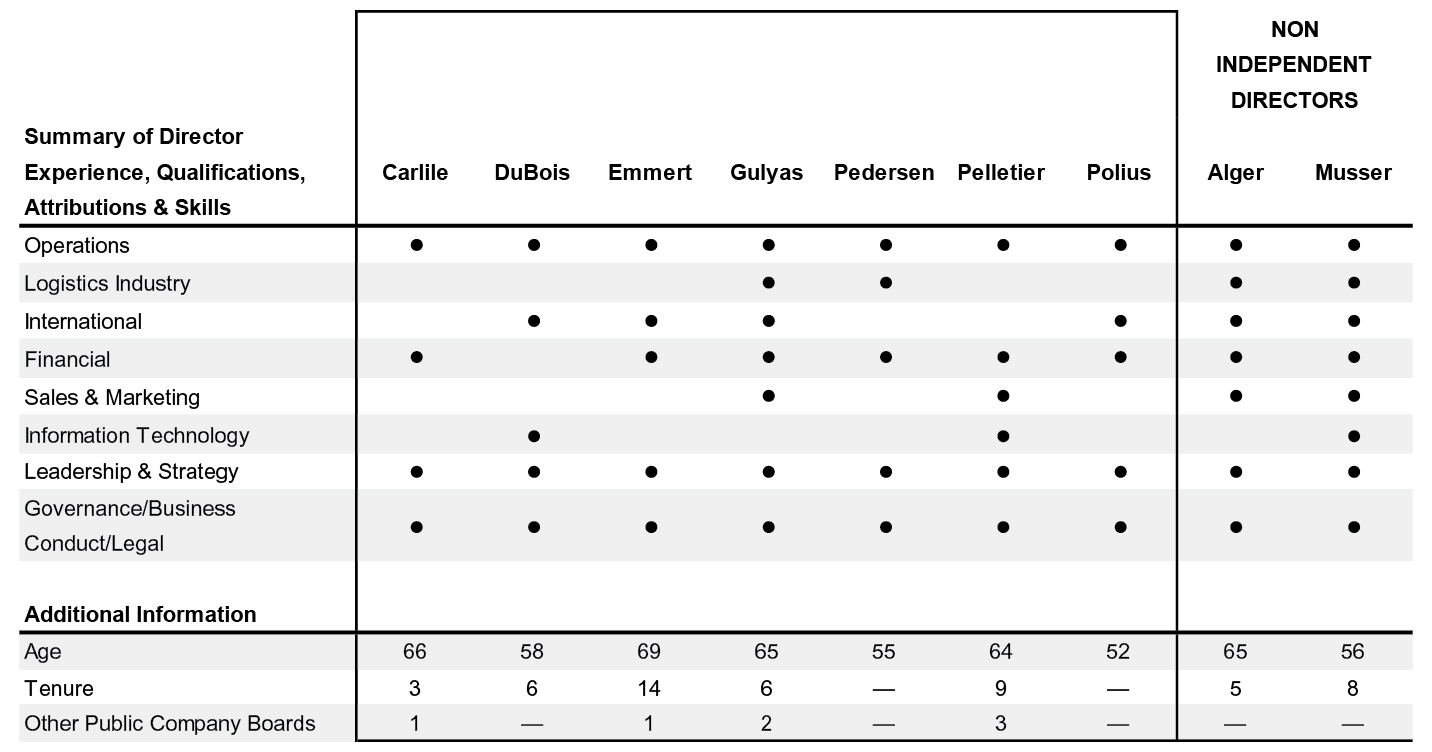

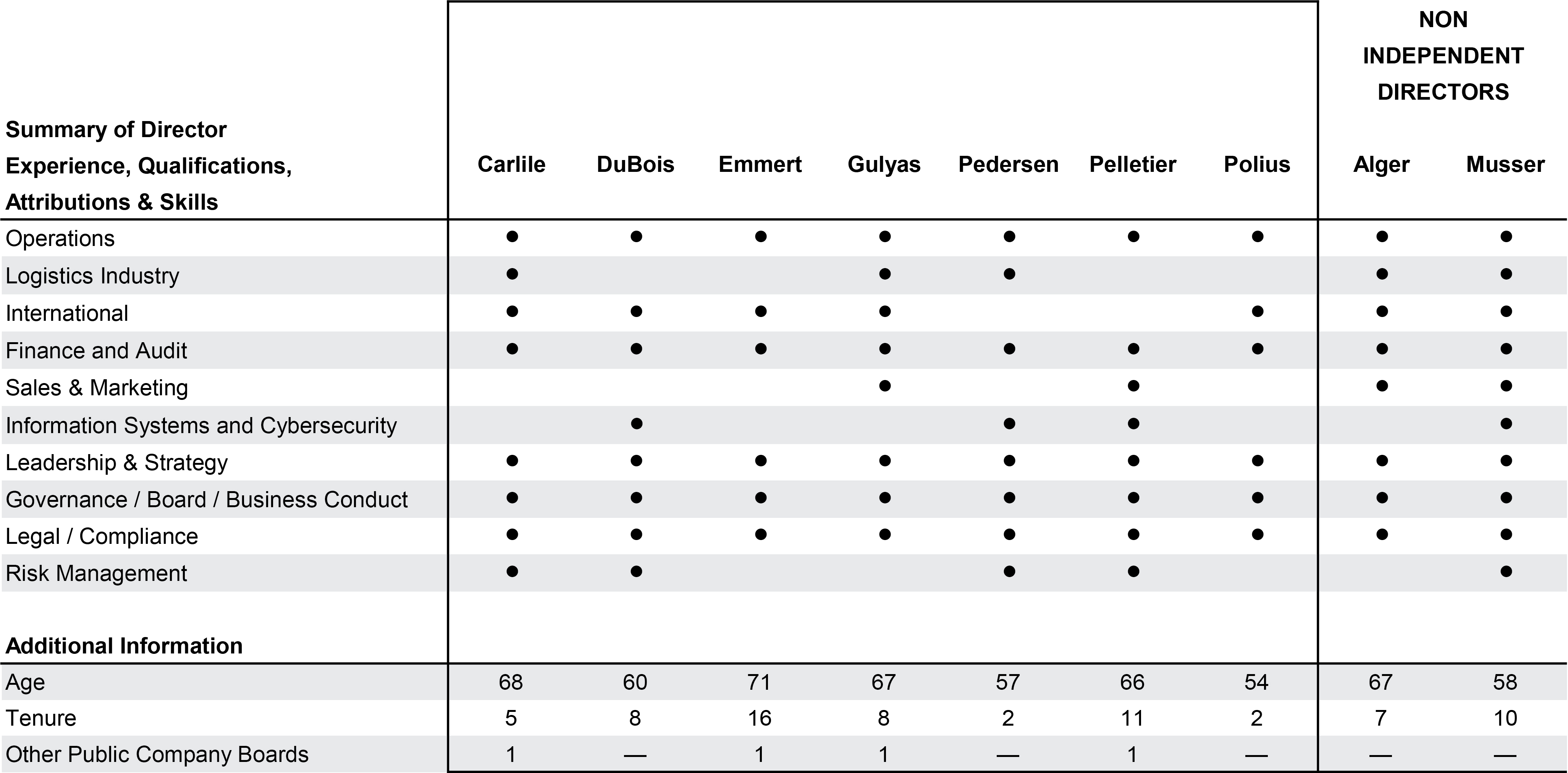

Summary of Director Nominee Experience, Qualifications, Attributes & Skills

Notice of Annual Meeting & Proxy Statement | 910

Our Board has the Relevant Experience and Skills Relevant to the Successful Oversight ofOversee our Strategy

Operations

Experience and insights into business operations is critical in assessing management’s ability to drive growth and nurture a strong corporate culture.

Logistics Industry

Logistics Industry

Experience in the global logistics industry, which is highly complex and dependent upon people, processes, and technology.

International

International

An understanding of diverse business environments, economic conditions, cultures, and regulatory frameworks, and a broad perspective on global market opportunities.

Financial

Financial

Senior-level experience of the finance function of an enterprise, with proficiency in complex financial management, capital allocation, and financial reporting processes.

Sales & Marketing

Sales & Marketing

Experience developing strategies to grow sales and market share, build brand awareness and equity, and enhance enterprise reputation.

Information Technology

A significant background working in technology, resulting in knowledge of how to anticipate technological trends, generate disruptive innovation, and extend or create new business models. Experience in the cybersecurity frameworks and processes that protect data and information.

Leadership & Strategy

A practical understanding of organizations, processes, strategic planning, and risk management. Demonstrated strengths in developing talent, planning succession, and driving change and long-term growth.

Governance/Business

A solid foundation in good governance practices and oversight, which are critical to all business operations and as a publicly traded company.

Conduct/Legal

An understanding of international laws and adherence to good conduct is critical for a large company that moves goods across borders around the globe.

The Board of Directors unanimously recommends a vote FOR the election of each of the Director Nominees

| Operations Experience and insights into business operations, which are critical in assessing management’s ability to drive growth and nurture a strong corporate culture. | |

| Logistics Industry Experience in the global logistics industry, which is highly complex and dependent upon people, processes, and technology. | |

| International An understanding of diverse business environments, economic conditions, cultures, regulatory frameworks, and a broad perspective on global market opportunities. | |

| Finance & Audit Senior-level experience in the audit and finance function of an enterprise, with proficiency in complex financial management, capital allocation, and financial reporting and internal control processes. | |

| Sales & Marketing Experience developing strategies to grow sales and market share, build brand awareness and equity, and enhance enterprise reputation. | |

| Information Systems and Cybersecurity A significant background working in technology, resulting in knowledge of how to anticipate technological trends, generate disruptive innovation, and extend or create new business models. Direct experience in the cybersecurity frameworks and processes that protect data and information. | |

| Leadership & Strategy A practical understanding of organizations, processes, strategic planning, and risk management. Demonstrated strengths in developing talent, planning succession, and driving change and long-term growth. | |

| Governance / Board / Business Conduct A solid foundation in good governance practices and oversight are critical to all business operations and publicly traded companies. Many of our Directors have deep public company board experience. | |

| Legal / Compliance An understanding of international laws and adherence to good conduct and compliance is critical for a large company that moves goods across borders around the globe. | |

| Risk Management Experience identifying, managing, and mitigating risks is essential for effectively overseeing the Company’s risk management. |

ü | The Board of Directors recommends a vote FOR the election of each of the Director Nominees. |

Notice of Annual Meeting & Proxy Statement | 11

10 | Expeditors International of Washington, Inc.

Board Operations, Practices and Procedures

The Board of Directors has policies and procedures to ensure effective operations and governance. Our corporate governance materials, including our Corporate Governance Principles, the Charters of each of the Board’s Committees, and ourthe Code of Business Conduct can be found on our website at https://investor.expeditors.com/corporate-governance/governance-documents. Currently the Board is composed of eight independent Directors and two non-independent Directors. Robert R. Wright has served as the independent Chair of the Board of Directors since May 2014 and is not standing for election at the 2022 Annual Meeting of Shareholders. The Board has elected Robert P. Carlile to serve as independent Chair of the Board upon election at the 2022 Annual Meeting of Shareholders.

The primary functions of Expeditors’ Board of Directors include:

Ensuring that the long-term interests of the Company are being served.

Assuring that Board discussions focus on forward-looking strategies, approving such strategies and monitoring related performance.

Overseeing the conduct of our business and monitoring significant enterprise risks.

Overseeing our processes for maintaining the integrity of our financial statements and other public disclosures, and compliance with laws and ethical conduct.

Evaluating CEO and senior management performance and determining executive compensation.

Planning CEO succession and monitoring management’s succession planning for other key executive officers; taking into consideration the diverse experiences, qualifications, and perspectives each potential succession candidate can bring to the Company including gender, race, and ethnicity.

Establishing tone at the top, effective governance structure, including appropriate Board evaluation, composition and planning for Board succession.

Ensuring the Company's commitment to maintain proper sustainability/Environmental, SocialCompany focuses on material matters that enable its sustainability; and Governance (ESG) standards.

The Board of Directors has determined that all current Directors except Messrs. Musser and Alger are independent under the applicable independence standards set forth in the rules promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act) and the rules of the NASDAQ Stock Market. The Board has designated that only independent Directors can serve as Committee members.

The Board currently has the following Committees: Nominating and Corporate Governance, Compensation, and Audit. Each Committee operates under a written charter, all of which are available on our website https://investor.expeditors.com/corporate-governance/governance-documents.

Board Practices & Procedures

The Board’s Committees analyze and review the Company’s activities in key areas such as financial reporting, internal controls over financial reporting; compliance with Company policies; corporate governance, social and environmental matters; significant risks; succession planning and executive compensation.

The Board and its Committee Chairs review the agendas and matters to be considered in advance of each meeting. Each Board and Committee member is free to raise matters that are not on the agenda at any meeting and to suggest items for inclusion on future agendas.

Each Director is provided in advance with materials to be considered at every meeting of the Board and Committees and has the opportunity to provide comments and suggestions.

The Board and its Committees provide feedback to management and management answers questions raised by the Directors during Board and Committee meetings.

Independent Board and Committee members meet separately at each Board and Committee meeting and as otherwise needed.

Independent Directors regularly hold executive sessions without management.

Notice of Annual Meeting & Proxy Statement | 11

Board AttendanceCorporate Governance Principles

The Board met six times in 20212023 and each Director attended at least 75% of the total number of Board of Directors meetings and Committee meetings on which they served. While the Company has no established policy requiring Directors to attend the Annual Meeting, all members attended the 20212023 Annual Meeting.

The Board’s governing principles include:

Notice of Annual Meeting & Proxy Statement | 12

Committee Composition

Composition and leadership of the three standing committees are determined following the annual shareholder meeting. From time to time, the Board rotates committee membership to deepen director skills required to deliver on committee responsibilities. Additionally, every committee meeting is open to and has included attendance of every Board director, in an effort to 'observe and learn'. Committee assignments made each year consider: expertise, capacity, and interest. Committee chair assignments consider: experience, capacity and interest. In all cases, the Board aims to compose each committee with members both new and tenured so that the work of the committee can proceed smoothly and efficiently.

Director Retirement Policy

The Board established a guideline, whereby an individual Director will not be nominated to stand for election to the Board of Directors at the next Annual Meeting if the Director has reached an age of 7275 years, absent a waiver of such guideline by the Board.

Board’s Role in Risk Oversight

Senior executive management is responsible for the assessment and day-to-day management of risk and brings to the attention of the Board the material risks to the Company. The Board provides oversight and guidance to management regarding material enterprise risks. Oversight responsibilities for certain areas of risk are assigned to the Board's three standing Committees and others are assigned to the full Board. The Board and its Committees regularly discuss with management the Company’s strategies, operations, compliance, policies, cybersecurity and inherent associated risks in order to assess appropriate levels of risk taking and steps taken to monitor, mitigate and control such exposures.

The Board believes the Company’s risk management processes are appropriate and that the active oversight role played by the Board and its Committees provides the right level of oversight for the Company. The Company experienced a cyberattack on February 20, 2022 and the Board has been actively overseeing the Company’s related investigation and recovery process.

SEC Filings & Reports

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports, are available free of charge on our website at https://investor.expeditors.com under the heading “Investor Relations” (see SEC Filings) immediately after they are filed with or furnished to the SEC.

12 | Expeditors International of Washington, Inc.

The Board uses a combination of cash and stock-based compensation to attract and retain qualified non-employee candidates to serve on the Board. In setting Director compensation, the Compensation Committee considers the amount of time that Directors expend in fulfilling their duties, as well as the skill level required as members of the Board and its Committees.

Board of Directors' Annual Compensation & Stock Ownership Requirements – Effective in 2022

Board Retainer | $125,000 in cash and $200,000 worth of Company restricted stock. |

Chair Retainers | An additional $175,000 retainer for the Chair of the Board. An additional $30,000 retainer for the Chair of the Audit Committee. An additional $25,000 retainer for the Chair of each of the Compensation Committee and the Nominating and Corporate Governance Committee. |

Stock Ownership Policy | Each Director is required to retain a minimum of 5x the cash Board retainer in Expeditors’ Common Stock, which is to be accumulated within the first 5 years of a Director joining the Board. |

Notice of Annual Meeting & Proxy Statement | 13

Director Compensation Table

The table below summarizes the compensation paid by the Company to non-employee Directors for the fiscal year ended December 31, 2021:2023:

Name | Fees Earned | Stock | Option | Non-Equity | All Other | Total |

Robert P. Carlile | $300,000 | 199,982 | — | — | — | $499,982 |

Glenn M. Alger | $125,000 | 199,982 | — | — | — | $324,982 |

James M. DuBois | $125,000 | 199,982 | — | — | — | $324,982 |

Mark A. Emmert | $150,000 | 199,982 | — | — | — | $349,982 |

Diane H. Gulyas | $125,000 | 199,982 | — | — | — | $324,982 |

Brandon S. Pedersen | $155,000 | 199,982 | — | — | — | $354,982 |

Liane J. Pelletier | $150,000 | 199,982 | — | — | — | $349,982 |

Olivia D. Polius | $125,000 | 199,982 | — | — | — | $324,982 |

Name | Fees Earned or Paid in Cash | Stock Awards (1) | Option Awards | Non-Equity Incentive Plan Compensation | All Other Compensation | Total |

Robert R. Wright | $265,000 | $199,982 | — | — | — | $464,982 |

Glenn M. Alger | $90,000 | $199,982 | — | — | — | $289,982 |

Robert P. Carlile | $115,000 | $199,982 | — | — | — | $314,982 |

James M. DuBois | $90,000 | $199,982 | — | — | — | $289,982 |

Mark A. Emmert | $110,000 | $199,982 | — | — | — | $309,982 |

Diane H. Gulyas | $90,000 | $199,982 | — | — | — | $289,982 |

Liane J. Pelletier | $110,000 | $199,982 | — | — | — | $309,982 |

Olivia D. Polius | $22,500 | — | — | — | — | $22,500 |

|

|

Notice of Annual Meeting & Proxy Statement | 13

SHAREHOLDER ENGAGEMENT & STOCK OWNERSHIP INFORMATION

Shareholder Engagement

In 2021, we engaged with shareholders representing 50%51% of our shares outstanding to discuss matters related tooutstanding.

shares outstanding.

Shareholder Feedback: Enhanced ESG Disclosure

We have always taken sustainability seriously and published our first public sustainability report in 2017, highlighting our commitments and progress across the ESG spectrum. We continue to enhance our disclosures of ESG matters while monitoring developments in ESG reporting. In response to shareholder feedback, in 2021 we first mapped and linked our many disclosures on a range of ESG topics to metrics outlined by the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) voluntary disclosure frameworks. Further details are included in the Nominating and Corporate Governance Committee Report in this proxy filing. Additional information about our programs to sustain a healthy environment and programs to reduce greenhouse gas emissions, as well as our approach social responsibility and sound governance can be found in our in our latest ESG report, which is updated annually: www.expeditors.com/sustainability.

Communicating with the Board of Directors

Shareholders may communicate with the Board of Directors and the procedures for doing so are located on the Company’s website at https://investor.expeditors.com. Any matter intended for the Board of Directors, or for one or more individual members, should be directed to the Corporate Secretary of the Company at 1015 Third Avenue, Seattle, Washington 98104, with a request to forward the same to the intended recipient(s). All shareholder communications delivered to the Corporate Secretary of the Company for forwarding to the Board of Directors or specified members will be forwarded in accordance with the instructions received.

Information regarding the submission of comments or complaints relating to the Company’s accounting, internal accounting controls or auditing matters can be found in the Company’s Code of Business Conduct on the Company’s website at https://investor.expeditors.com.

Information Requests

We ask that all requests for corporate information concerning Expeditors’ operations be submitted in writing. This policy applies equally to securities analysts and current and potential shareholders. Requests can be made to Expeditors International of Washington, Inc., 1015 Third Avenue, Seattle, Washington 98104, Attention: Chief Financial Officer, or by email to investor@expeditors.com.investor@expeditors.com.

Written responses to selected inquiries will be released to the public by a posting on our website at https://investor.expeditors.com and by simultaneous filing with the Securities and Exchange Commission (SEC) under Item 7.01 on Form 8-K.

Notice of Annual Meeting & Proxy Statement | 14

Fair Disclosure

Any analyst or investor contact, whether by telephone or in person, will be conducted with the understanding that questions directed at ongoing operations will not be discussed. Management will limit responses to discussions of previously disclosed information, including informational discussions directed to the history and operating philosophy of the Company and an understanding of the global logistics industry and its competitive environment. Expeditors will, of course, make public disclosures at other times as required by law, regulation or commercial necessity.

14 | Expeditors International of Washington, Inc.

Five Percent OwnersOwners of Company Stock

The following table sets forth information, as of December 31, 2021,2023, with respect to all shareholders known by the Company to be beneficial owners of more than 5% of its outstanding Common Stock. Except as noted below, each entity has sole voting and dispositive powers with respect to the shares shown.

Name & Complete Mailing Address | Number of Shares |

|

| Percent of Common Stock Outstanding | |

The Vanguard Group |

| 17,214,458 |

| (1) | 11.84% |

BlackRock, Inc. |

| 16,489,744 |

| (2) | 11.30% |

State Street Corporation |

| 8,093,997 |

| (3) | 5.57% |

Name & Complete Mailing Address | Number of Shares |

| Percent of Common Stock Outstanding |

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | 22,923,231 | (1) | 13.50% |

The Vanguard Group 100 Vanguard Boulevard, Malvern, PA 19355 | 19,485,313 | (2) | 11.50% |

Loomis Sayles & Co., L.P. One Financial Center, Boston, MA 02111 | 10,165,441 | (3) | 6.00% |

State Street Corporation State Street Financial Center One Lincoln Street, Boston, MA 02111 | 9,300,226 | (4) | 5.49% |

|

|

|

|

|

|

|

|

Notice of Annual Meeting & Proxy Statement | 15

Security Ownership of Directors & Executive Officers

The following table lists the names and the amount and nature of the beneficial ownership of Common Stock of each Director and nominee, of each of the NEO described in the Summary Compensation Table, and all Directors and Executive Officers as a group at March 8, 2022.12, 2024. Except as noted below, each person has sole voting and dispositive powers with respect to the shares shown.

DIRECTORS | Amount & Nature of

| Percent of Class | |||||

Robert |

| * | |||||

Glenn M. Alger (1) |

| * | |||||

|

| * | |||||

|

| * | |||||

|

| * | |||||

|

| * | |||||

|

| * | |||||

|

| 35,353 |

| * | |||

|

| * | |||||

|

|

| |||||

ADDITIONAL NAMED EXECUTIVE OFFICERS | |||||||

|

| * | |||||

|

| * | |||||

|

| * | |||||

Bradley S. Powell (7) |

| * | |||||

All Directors & Executive Officers as a Group (17 persons)(8) |

| * | |||||

* Less than 1%

Notice of Annual Meeting & Proxy Statement | 16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 | Expeditors International of Washington, Inc.

NOMINATING & CORPORATE GOVERNANCE COMMITTEE REPORT

The Nominating and Corporate Governance Committee is committed to proven corporate governance policies and procedures designed to continuously improveassuring that the effectiveness of theCompany’s Board and its Committees.Committees are fit for purpose; contribute to the Company’s strategy and sustainability; and continuing to learn and improve how it governs.

Nominating & Corporate Governance Committee

The committee charter is available at https://investor.expeditors.cominvestor.expeditors.com.

All members are independent under Exchange Act and NASDAQNYSE rules.

Key Responsibilities:

Determine the criteria for Board membership.

Lead the search for qualified individuals to become Board members, taking into consideration various criteria including a candidate’s contribution to Board diversity including gender, race and ethnicity.

Utilize the so-called “Rooney Rule” for CEO and Board candidates recruited from outside the Company so that any initial list of candidates includes qualified female and racially/ethnically diverse individuals.

Recommend the composition of the Board and its Committees.

Monitor and evaluate changes in Board members’ professional status.

Conduct evaluations of Board and Committee effectiveness.

Maintain and advance a set ofthe Corporate Governance Principles.

Maintain thePrinciples and Company’s Code of Business Conduct and oversee itstheir compliance.

Assist in evaluating governance-related inquiries commentary and proposals.

Analyze current and emerging governance trends for impact on the Company.

Oversee the Company's Materiality Assessments that inform the Sustainability / ESG strategy and programs which in turn are embedded in corporate strategy, enterprise risk management, culture, and Board oversight. Oversee those enterprise risks that are assigned to the Committee by the Board.

Monitor Directors' compliance with stock ownership guidelines.

Oversee the Company's ESG strategy and programs.

20212023 Committee Highlights

The Nominating and Corporate Governance Committee met four times in 2021.2023.

Added two new independent board members (Nov 2021 and Feb 2022) as partOversaw the maturation of work around ESG materiality. In previous years, the Board’s multi-year succession plan. The Board nominees’ tenure profile is now: 3 DirectorsCompany conducted a Materiality Assessment to identify which factors (that fall under 5 years; 5 Directors between 5 and 10 years; and one Director over 10 years.

Named new Chairmanthe ESG umbrella) are pertinent to the sustainability of Board effective May 2022.

Recomposed Board CommitteesExpeditors. As expected, the small number of identified factors aligned with the culture of Expeditors, but as a result of two additions and change in Chairman.

Oversaw the Company's continuing evolution of its global Code of Business Conduct guidelines.

OversawMateriality Assessment work, they are now formally programmed into the Company’s ESG strategy and programsEnterprise Risk program. Further, each factor has an executive owner along with Board or Committee oversight responsibility and itscadence. Audit, Compensation and Nominating and Corporate Governance committee charters have all been updated Sustainability Report, disclosed onlineas has the Enterprise Risk program.

Established plans for a Materiality Assessment of ESG factors in 2022.

Reviewed and kept current the Company’s enterprise risk management program.

Conducted board and committee evaluations to assure continuous improvement.

Continued to invest in Board education, including Board sessions on cybersecurity; innovations in the Company’s cybersecurity programlogistics market; macroeconomic and assuring compliance with SEC-related guidance.

Regularly monitored and discussed current and emerging governance issues identified by the SEC, other regulators across the globe, and those of interest to our significant stakeholders.

Notice of Annual Meeting & Proxy Statement | 17

OUR COMMITMENT TO SUSTAINABILITY – ESG

Corporate Governance Principles

The Committee operates accordingBoard of Expeditors has communicated our messages about ESG to shareholders each of the last few years. In each proxy, we communicate that ESG to us means Sustainability in the most fundamental sense. To us, that means focusing on only those factors that are relevant and essential to the Board’s Governance Principles, availablebusiness strategy, performance and culture of the Company. Focusing on factors that drive performance will help make the Company thrive for the long term. To repeat prior year’s messages, the Board believes our website at https://investor.expeditors.com, which includes:

Commitmentresponsibility toward ESG starts with “G.” It works to assure that good governance is well established and followed for anything that fundamentally affects the long-term interestssustainability of all stakeholders.the Company.

Annual election2023 brought some important developments on Sustainability.

The results of all Directors.

So-called “Rooney Rule” requirement that any initial list of CEO and Board candidates recruited from outside the Company will include qualified female and racially/ethnically diverse individuals.

UnderESG Materiality Assessment completed in the prior years have fully matured into the Company’s resignation policy, any Director who does not receive a majority vote in an uncontested election will resign immediately.

Availability of proxy access for qualifying shareholder groups.

Independent Board Chair.

strategy and Enterprise Risk programs. The majority ofrelevant factors that came from the Board is comprised of independent Directors.ESG Materiality Assessment are:

G: - Business Ethics

- Cybersecurity and Data Privacy

E: GHG emissions and reductions / customer focus on green solutions

S: Talent management / employee engagement

Each of the three Board Committees is composed of only independent Directors.

Each of these key factors have been assigned Board or Committee operatesownership with defined reporting cadence

Governance: The Company Has a Mature Framework

Three factors from the Materiality Assessment clearly fall under a written charter“G” of ESG –complementing our total system of governance.

Business Ethics are foundational to Expeditors and have been since day one. The company’s Chief Ethics and Compliance Officer (CECO) leads the work that has been approvedguides every employee on principles of conduct and reminds every employee that how work is done is as important as what work is done. Every employee must abide by the Board.

Any Board action must be approved by a majority of the independent Directors.

Each of the three Committees has the authority to retain independent advisors.

The Board and each Committee annually evaluates its performance.

No shareholder rights plan (poison pill).

No pledging, hedging or engaging in any derivatives trading of Company shares allowed by employees or Directors.

No Company spending on political campaigns and clear written policies against endorsing political parties or individual candidates; making any Company premises available for political or campaign purposes; or contributing funds to political campaigns, including indirect contributions for the purpose of electioneering or making a campaign donation on the Company’s behalf.

Annual Director certification of compliance with the Code of Business Conduct (Code) and there are many resources available at https://investor.expeditors.com

Director stock ownership requirements.

Considerations for Director Nominations

to promote understanding of the Code. The Committee followsCode is translated into nine languages to reach the board’s policy on director nominations,employees working across the globe. Compliance specialists in every time zone are available on our website https://investor.expeditors.com, which features a number of criteria for nominations such as:

Integrity and judgment.

Independence.

Knowledge and skills.

Experience and accomplishments.

Contribution to Board diversity in all aspects, including gender, race and ethnicity.

18 | Expeditors International of Washington, Inc.

ESG OVERSIGHT: EXPEDITORS’ COMMITMENT TO SUSTAINABILITY

Expeditors has always been committedassist with questions about the Code, escalating directly to the fundamental valuesCECO when needed. The Code also applies to third parties who do work for Expeditors. Every employee and Board Director is evaluated each year to ensure understanding and compliance with the Code. The NCGC Committee has been assigned oversight of good environmental, social and governance (ESG) corporate citizenship sincethis program. Readers can access the Code on the Company website https://investor.expeditors.com/corporate-governance/governance-documents to appreciate the scope of this shared responsibility.

Business Continuity is critical to our Company’s inception. Indeed, this commitment is part ofongoing success. With oversight by the Audit Committee, Expeditors developed an overall plan that empowers our business model and is reflected in the various long-standing mechanismsemployees to address disasters or other situations that may pose a threat to our people, operations or customers' assets. With our Business Continuity Plan, we have putformalized responsibilities and procedures for contacting the appropriate people in placecase of an emergency, using pre-established avenues of escalation for branches. In the event of an emergency, our plan will act as a reference point for communication to promoteeach branch, and each district has a crisis management team and locally specific plan to respond to these types of situations. Moreover, in 2023 the best interestsCompany conducted various table-top exercises, including some in partnership with government agencies, designed to test these practices and procedures for a wide range of emergencies, including political unrest, terrorist acts, pandemics, cyber-attacks and power outages, and all Expeditors’ stakeholders – including our shareholders, employees, service providers, customerstypes of natural disasters.

Cybersecurity and communities. We fully understand and closely monitor our stakeholders’ interests in ESG risks and opportunities.

While the topic and issues that today fall under the rubric of "ESG"Data Privacy are not new to Expeditors, and many of them are rooted in our culture and business model, we recognize and appreciate that – especially for shareholders – distilling factors into standard measures is what will ultimately be most efficient for markets. Accordingly, as various voluntary reporting frameworks continue to emerge and coalesce, we have continued to provide meaningful disclosures using the framework of the Task Force on Climate-Related Financial Disclosures (TCFD) and relevant Sustainability Accounting Standards Board (SASB) standards applicablealso table stakes, critical to our non-asset, knowledge-based business model.

We approach ESG as completelyongoing success. Security and intricately linked to our strategy. It is through that lens that we plan to conduct a third-party Materiality Assessmentprivacy requirements are embedded in 2022. Our goal will be to rely upon any insights from that study to underpin our future disclosures and programs around ESG. As we align the Company’s strategy, operations, and risk management. The Company has several formal governance bodies to address evolving security and privacy requirements. The full Board provides oversight of the cybersecurity and data privacy programs, with ESG initiatives,a global privacy policy that provides global standards governing access and use of personal data. Management organizes its work on these and other risks through its Enterprise Risk Management Committee. Reporting to the CompensationEnterprise Risk Management Committee is considering linking a portion of CEO compensation to certain ESG outcomes based on the findingsEnterprise Cybersecurity Committee, which defines the strategy, prioritizes, and sets the expectations for execution of the competed Materiality Assessment.

Our executive team is firmly committed to good ESG principlescybersecurity program, leveraging an industry-standard cybersecurity framework and we have well-established ESG employee committees, all undertaken with continuous oversight by our BoardNational Institute of Directors. We were honored to have been named asStandards and Technology cybersecurity framework (NIST CSF). The Cybersecurity and Information Services Department executes the highest ranked logistics company (and 14th overall) incybersecurity program and implements controls throughout the 2020 Best ESG Companies Top 50 list published by Investor’s Business Daily and receive a AAA rating (their highest rating) from MSCI, an investment research firm. We are proud of the fact that this achievement was a natural consequence of executing our core business strategy effectively and ethically. We are also proud of the fact that we adopted a “no layoff” policy in 2020 during the early stages of the pandemic. This approach was the right thing to do for our employees. It also paid dividends: as demand for our services increased over 2020 levels, our loyal, trained employees were there, and rose to the occasion to service our customers.Company’s

Additional information about our programs to sustain a healthy environment and to reduce greenhouse gas emissions, as well as our approach to social responsibility and sound governance is set forth below and can also be found in our latest ESG report, which is updated annually: www.expeditors.com/sustainability.

THE ENVIRONMENT

Deepening our Resolve

On the environmental front, we are taking additional steps both to manage our own GHG emissions and to help our customers eliminate waste and pursue their own supply chain transformation strategies. In 2021, we took the step of creating a new role for our organization, Director – Environmental Sustainability. This position will help further our external environmental engagement efforts with customers and service providers, as well as our internal initiatives around recycling, efficiency, and GHG reduction. In addition to conducting a third-party Materiality Assessment, in 2022 we also plan to set our own Scope 1 & 2 GHG emissions targets. As we gain momentum with these steps forward, we will continue to focus on making a difference not only by managing our own emissions, but also by collaborating with our customers and service providers – something we are well-positioned to do because we operate as an intermediary at the supply chain orchestration level (i.e., we are non-asset based).

Our Non-Asset Business Model Drives Supply Chain Sustainability

Freight consolidation is at the core of our business. It involves the combining of multiple different shipments in an efficient manner in order to maximize space utilization and, consequently, minimize the consumption of resources. Therefore, freight consolidation saves money for our customers while being measurably better for the environment by reducing unnecessary waste. In performing this important supply chain optimization role, Expeditors operates using a non-asset business model, meaning that we do not own or operate any airplanes, ships or trucks. This model affords several important advantages when it comes to the effective management of Greenhouse Gas emissions, not least of which is our ability to accelerate transitions to more modern, fuel-efficient fleets as they become available in the market, thereby further improving overall supply chain sustainability for Expeditors and our customers.

Offering “Green Logistics Solutions” that Drive Efficiency

A key challenge in reducing GHG emissions in supply chains is providing an efficient system for demand to flow to “greener” assets. Our non-asset business model gives us maximum adaptability: as carriers invest in cleaner technologies, and our customers indicate a desire to route cargo via cleaner assets, we can direct our customers’ freight to the most optimal solutions. We are uniquely positioned to help our customers leverage more fuel-efficient

Notice of Annual Meeting & Proxy Statement | 1918

global operations. The Company uses cybersecurity technologies and services to prevent, identify, detect, respond, and recover from cybersecurity threats and incidents. The program regularly evaluates potential or existing cyber threats from third party service providers. To augment internal cyber security work, the Company engages third parties, (including consultants, auditors, and cyber-specialists) to support, evaluate, and improve the program. In August 2023, the Company added a new role - Chief Information Security Officer - and appointed a well-seasoned cybersecurity expert to work closely with our Chief Information Officer.

fleetsThe Company’s Data Protection Officer collaborates with the Cyber Security team, bringing compliance requirements for data protection overall, addressing the rapidly changing needs of various governmental bodies across the globe.

For more information on our approach to cybersecurity, see Cybersecurity – Risk Management and lower carbon routing options precisely because we do not ownStrategy in our most recent form 10-K filing: https://www.sec.gov/Archives/edgar/data/746515/000095017024019394/0000950170-24-019394-index.htm

Environment: The Company Has a Dual Focus

Expeditors complies with all environmental laws and regulations and maintains an active commitment to environmental matters across the globe. The results of the Materiality Assessment complemented this commitment and focused the Company on GHG emissions and reduction strategies. For Expeditors, this “E” focus within ESG takes hold in two ways: